Cost of registration

from 1890 EUR

The cost of the second year

from 790 EUR

Table of contents

Registration of a Company in Bulgaria

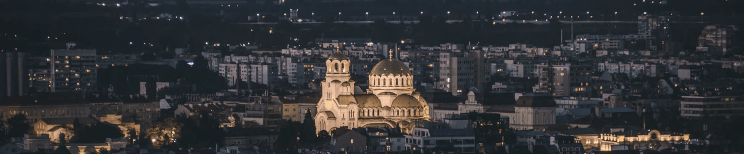

The Republic of Bulgaria is situated in Eastern Europe and occupies the east of the Balkan Peninsula. Bulgaria borders Romania to the north, Serbia to the northwest, Greece to the South, Turkey to the southeast and North Macedonia to the southwest. The capital and largest city in Bulgaria is Sofia. The population of Bulgaria is over 7 million people.

Bulgaria is famous for its Black Sea resorts, with services in those resorts marked by the environmental award "Blue Flag". Musala mountain is the highest point of the country and the Balkans. The city of Varna is known for the largest European steel bridge, the bridge of Asparukh (its length is 2 km, height - 75 m). The Bulgarian flag has a white, green and red stripe signifying symbols of freedom, peace, its forest, agricultural land, and bloodshed in their struggle for independence.

The Bulgarian economy has been steadily growing for the past five years. The tax system of Bulgaria is currently one of the lowest in Europe making it a tax haven for investors. Bulgaria is a member of the European Union, NATO, World Trade Organization, Council of Europe, ATS, OSCE and the United Nations. The government is a democratic parliamentary Republic.

ADVANTAGES OF COMPANY FORMATION IN BULGARIA

The following are the benefits of incorporating a company in Bulgaria, they include:

-

The favourable geographical position of the country makes its routes important for transit across Europe.

-

Bulgaria is an EU member.

-

Its corporate tax rate is one of the lowest in Europe.

-

Withholding tax on emanating dividends amounts to only 5%.

-

Engaging in commercial activities and working as a manager without obtaining a work permit;

-

Purchase of land (A foreign citizen is not allowed to purchase land in Bulgaria but a foreign company is allowed to do so);

-

The company has the right to choose the form of bookkeeping (standard forms can be replaced by IFRS).

-

Formation of a company in Bulgaria is easy and fast.

In addition, the Bulgarian legislation provides equal rights to Bulgarian and foreign-owned businesses. Foreign investors, investing large amounts (millions of dollars) in their businesses are also entitled to certain attractive benefits.

TAXES IN BULGARIA

Bulgarian companies are taxed at the following rates:

-

The Corporate tax and Income tax rate are at 10%.

Every company in Bulgaria pays tax on international gained profits, including foreign branch offices (pay tax on their income) but the parent company’s income is not taken into account.

-

Income derived from paid dividends is not included in the tax base. Withholding tax amounts up to 5%.

-

Non-residents pay tax on income from interests on securities and financial leasing at the rate of 10%, and fee received for rendering technical services in the transactions. There are also certain tax percentages on the cost of services, leasing operations, income from factoring and franchising, the sale of a company via its financial assets and income from the provision of intellectual rights implementation.

-

A VAT is paid at two rates:

Taxable transactions of the main category - 20%;

Exports/other types of transactions provided for in international agreements - 0%

REQUIREMENTS TO REGISTER A COMPANY IN BULGARIA

-

Minimum of one director;

-

Minimum of one shareholder;

-

A legal entity can be a director;

-

A legal address in Bulgaria;

-

Nominee shareholders and directors;

-

Articles of Association;

-

Certificate of incorporation;

-

An LLC can be registered with a minimum authorized capital of 5 000 BGN, and for a joint venture - with a capital of 50 000 BGN. 70% at least of the share capital should be paid during the registration.

BUSINESS REGISTRATION IN BULGARIA: TYPES OF COMPANIES

The Foreign company registration options in Bulgaria include the following;

-

Individual Limited Liability Company (EOD) – A single owned entity with limited responsibility(one founder);

-

Public Limited Company (AD) – joint stock company – a commercial company with share capital owned by its members;

-

Private Limited Liability Company (OOD)– Two or more partners with limited responsibility (two or more founders);

-

Sole Proprietorship (ET);

-

Freelance (Individual contractors)

-

A foreign branch in Bulgaria – A foreign incorporated company can open a branch in Bulgaria.

PROCESS OF BUSINESS REGISTRATION IN BULGARIA

The registration process begins with a free consultation and expert assessment from our lawyers, ensuring it complies with the requirements of new company registration. After which, our specialists collect, prepare the necessary documents and submit the application for company registration. At the end of the registration procedure, the certificate of Incorporation may be delivered to you via courier service or an email addressed by the founders of the company. Company registration and incorporation gives operational and transactional rights in Bulgaria.

BULGARIA COMPANY FORMATION FAQs

Is Bulgaria an offshore territory?

Offshore company registration in Bulgaria is not possible as Bulgaria is not an offshore territory.

How can I check if a company is registered in Bulgaria?

Contact Law and Trust International, our Lawyers get in touch with the ‘Commercial Registry of Bulgaria’, working with them closely to verify the registration of a business or company.

How much does it cost to register a company in Bulgaria?

The cost of registering a company in Bulgaria costs $1840, the total cost includes the preparation of legal documents, company registration, payment of all taxes and fees at the time of registration and legal address for the company (a year).

How long does it take to register a company in Bulgaria?

The registration of a company in Bulgaria takes from two (2) weeks.

How to register a foreign company in Bulgaria?

Registering a foreign company in Bulgaria has to conform with the requirements given by the Bulgarian Commercial Registry. Contact Law and Trust International to get a professional view on registering a foreign company in Bulgaria.

Why Incorporate with Law&Trust International?

Benefits of company registration, formation, and incorporation services with Law&Trust International in Bulgaria includes:

Full range of related services: Provision of a full range of legal, corporate, government, and business intelligence related services in Bulgaria. A detailed overview of our services includes full legal support of the company registration procedure, obtaining a legal address, interaction with the official government authorities of the jurisdiction, state fees, legal address of the company for a year, production and registration of company stamps and advising the client as part of the registration process. Opening a bank account and the cost of these services are discussed during the consultation.

Professionals and expertise of Law: Worldwide registration and legal maintenance of companies, accounting services, and audit, tax planning and optimization, trademark and patent registration. Law and Trust provide clients with the best company incorporation services.

Domestic service: Law&Trust ensure our services cover every region in Bulgaria. Be rest assured that no matter where the new company intends to incorporate in Bulgaria, we’ve got the location covered.

Free initial advice: Free consultation from the lawyers of Law&Trust International regarding strategies or the provision of services for analyzing and developing a legal position on an issue the client raises in Bulgaria.

Confidentiality: Law&Trust makes use of modern technological features to keep the records and details of every client safe.

Efficiency and productivity: Strategically providing up to date personalized services to help your business succeed.

Ready for Company Incorporation?

If you are interested in registering and incorporating a company in Bulgaria, contact Law & Trust International by simply sending an email or call now to take your business to the next level!