News: foreign law and tax legislation worldwide

— Tatyana, hello! Please tell us about your role at Law&Trust Internati…

We officially declare that: We have never issued, do not issue, and cannot…

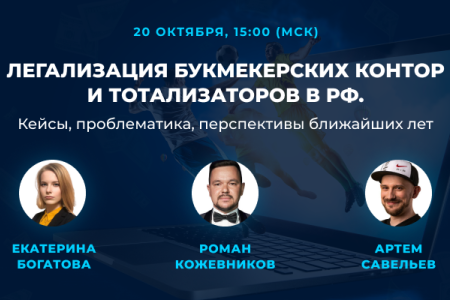

During the webinar, speakers will address topics relevant to legal represen…

In 2019, a number of international offshore jurisdictions faced a policy o…

Important notice: Law&Trust no longer operates in Russia. Law&Trus…

The European Commission has updated the list of countries that do not have…

After the explosive activity of 2017, crypto markets are experiencing sever…

Starting December 21, 2018, amendments to securities market legislation cam…

Pagination

Our team

Our clients

Contact us

We will provide detailed information on how we can help you, calculate the cost and timeline.

A team of experts at your service.