Law&Trust has been offering legal services for 20 years, covering a wide range of areas such as

- formation of legal entities worldwide,

- maintenance of legal entities,

- acquiring licenses,

- opening bank accounts,

- providing accounting and auditing services,

- tax planning,

- and more..

Регистрация компаний (юридических лиц)

Сегодня Law&Trust предлагает зарегистрировать или купить, а также юридически обслуживать, компании (в том числе оффшорные) в 134 юрисдикциях по всему миру.

Мы предлагаем:

- регистрация и обслуживание компаний в любой стране мира, в том числе в оффшорных зонах;

- подготовка соответствующих документов (устав, учредительный договор, доверенности и т.д.);

- услуги секретарской компании (регистрационного агента);

- предоставление регистрационного (юридического) адреса;

- предоставление услуг профессионального законного номинального сервиса (акционер, директор, партнер);

- нотариальное и апостиллированное заверение пакета документов компании;

- ведение бухгалтерского учета, подготовка бухгалтерской отчётности, аудит и подача отчётов в налоговый орган;

- получение сертификатов Good Standing, Incumbency, Tax residence и т.д.;

- и многое другое.

Открытие банковских счетов

Открыть счет в банке в любой стране мира – это просто, если Вы клиент компании Law&Trust. Мы не только откроем персональный или корпоративный банковский счет, но и поможем выбрать оптимальное финансовое учреждение для оптимизации затрат на банковское обслуживание.

Банковский счет является тем инструментом, без которого невозможно представить полноценное функционирование любой компании. Поэтому задача открытия счета и обеспечения непрерывного и бесперебойного его функционирования является неотъемлемой частью организации бизнеса.

Наша компания сотрудничает с огромным количеством зарубежных банков по всему миру. Поэтому, если Вам нужна помощь в выборе подходящего банка, то наши специалисты всегда готовы подобрать банк под Ваши пожелания.

Бухгалтерские услуги и аудит

Доверяйте финансовую отчётность профессионалам! Мы обеспечим точный учет, своевременную сдачу отчётов и качественный аудит для вашего бизнеса. Гарантируем прозрачность, законность и законную оптимизацию налогов.

Мы оказываем лицензированные услуги по таким направлениям:

- Ежемесячные бухгалтерские услуги;

- Подготовка бухгалтерской и налоговой отчётности;

- Подготовка управленческой отчётности;

- подготовка и прохождение аудита;

- Бухгалтерские и аудиторские консультации;

- подача всех видов финансовой и налоговой отчётности в различных юрисдикциях, включая Великобританию, ОАЭ, Гонконг, США, Кипр, Сингапур и многие другие.

Регистрация торговых марок (знаков)

Никто не сможет безнаказанно использовать Ваше торговое наименование, если оно зарегистрирован!

Если Вам необходимо зарегистрировать торговую марку (знак) или право интеллектуальной собственности в любой стране мира по национальной (локальной) процедуре, либо по процедуре Всемирной организации интеллектуальной собственности (WIPO), OHIM и иных, специалисты Law&Trust International все возьмут на себя под ключ.

Регистрация патентов

Создали уникальную технологию или изобретение? Наша юридическая компания поможет вам зарегистрировать патент, чтобы вы могли защитить свои разработки и получить законные права на их использование.

Наши услуги включают:

- Анализ патентоспособности вашего изобретения.

- Подготовку и подачу документов в патентное ведомство.

- Сопровождение на всех этапах регистрации.

- Решение сложных вопросов и споров, связанных с патентами.

- Международную регистрацию для защиты прав на глобальном уровне.

С нами вы гарантированно защитите свои интеллектуальные права и получите конкурентное преимущество на рынке.

Регистрация морских судов и самолетов

Нужна регистрация судна или самолета в надежной юрисдикции? Мы обеспечим профессиональное сопровождение на всех этапах, чтобы ваш транспорт соответствовал всем международным стандартам и требованиям законодательства.

Почему выбирают нас:

- Подбор оптимальной юрисдикции для минимизации налогов и защиты активов;

- Подготовка и подача всех необходимых документов;

- Конфиденциальность и строгое соблюдение законодательства;

- Решение любых проблем с регуляторами;

Мы работаем с владельцами частных и коммерческих судов и самолетов, обеспечивая индивидуальный подход к каждому клиенту. С нами ваш транспорт будет зарегистрирован без лишних сложностей и рисков.

Открытие мерчант аккаунтов, эквайринг

Поможем вашему бизнесу принимать платежи по всему миру!

Быстрое и безопасное открытие мерчант-счетов (эквайринг) в надёжных банках и платёжных системах (EMI, API). Специалисты Law&Trust в кратчайшие сроки и с учетом индивидуальных требований помогут Вам с выбором оптимального финансового провайдера и проведут все этапы открытия счета для осуществления расчетов по VISA, MasterCard, UnionPay, American Express и т.д., в том числе для middle и high-risk.

Юридические услуги на Ближнем Востоке

Планируете вести бизнес на Ближнем Востоке или уже работаете в регионе? Наша юридическая компания предлагает комплексные услуги, которые помогут вам успешно реализовать свои проекты и защитить интересы в странах Ближнего Востока.

Наши услуги включают:

- Регистрация компаний и сопровождение бизнеса в странах GCC (ОАЭ, Саудовская Аравия, Катар и др.).

- Юридическое сопровождение сделок, контрактов и проектов.

- Консультации по налоговому и корпоративному праву региона.

- Помощь в получении лицензий, ВНЖ, ПМЖ и релокации.

- Решение правовых споров и арбитраж.

Почему мы:

- Глубокое знание законодательства и особенностей ведения бизнеса на Ближнем Востоке.

- Индивидуальный подход к каждому клиенту и его задачам.

- Прямые связи с местными партнерами и государственными органами.

- Полная конфиденциальность и профессионализм.

Управление недвижимостью в ОАЭ

Владеете недвижимостью в ОАЭ? Наша компания предлагает профессиональные услуги по управлению вашей недвижимостью, чтобы вы могли получать стабильный доход без лишних хлопот.

Что мы предлагаем:

- Поиск арендаторов и заключение договоров аренды.

- Контроль за состоянием объекта и организация ремонта.

- Управление платежами: аренда, коммунальные услуги, налоги.

- Консультации по увеличению доходности объекта.

- Полное юридическое сопровождение сделок и взаимодействие с государственными органами.

Почему выбирают нас:

- Глубокое знание рынка недвижимости ОАЭ.

- Индивидуальный подход к каждому объекту и клиенту.

- Полная прозрачность и регулярная отчетность.

- Экономия вашего времени и защита ваших интересов.

Получение финансовых лицензий

Law&Trust поможет получить финансовую лицензию для осуществления платежей от имени клиентов быстро, профессионально и с минимальными рисками.

Мы обеспечим:

- Подбор подходящей юрисдикции с учетом ваших бизнес-целей.

- Подготовку и оформление всех необходимых документов.

- Полное сопровождение процесса подачи заявки.

- Уверенность в соответствии требованиям регулирующих органов.

Мы знаем, как сократить сроки и избежать ошибок, чтобы вы могли сосредоточиться на развитии бизнеса.

Получение криптовалютной лицензии

Law&Trust предлагает комплексное сопровождение в получении криптовалютной лицензии для вашего бизнеса. Мы поможем вам легализовать деятельность в сфере криптовалют, минимизировать риски и обеспечить полное соответствие требованиям законодательства.

Получение инвестиционной лицензии

Строите брокерский или инвестиционный бизнес?

Law&Trust обеспечит быстрое и безошибочное получение инвестиционной лицензий в кратчайшие сроки. Полный контроль процесса, минимальные расходы и индивидуальный подход к каждому клиенту.

Получение игорной (гемблинг) лицензии

С нашей помощью вы получите лицензию для казино, онлайн-гейминга, букмекерской деятельности или других гемблинг проектов, соответствующую всем международным стандартам в 40 юрисдикциях по всему миру.

Почему мы:

- Подберем юрисдикцию с выгодными условиями для вашего проекта.

- Подготовим и подадим все необходимые документы.

- Выполним все требования регулирующих органов.

- Обеспечим полное сопровождение на каждом этапе получения лицензии.

Регистрация трастов / фондов

Ищете надежный способ защитить свои активы и обеспечить финансовую стабильность? Наша юридическая компания предоставляет профессиональные услуги по регистрации трастов в ведущих международных юрисдикциях.

Что вы получите:

- Надежную защиту активов от рисков и посягательств.

- Эффективные инструменты управления наследством.

- Оптимизацию налоговых обязательств.

- Конфиденциальность и соблюдение всех юридических норм.

Мы берем на себя весь процесс: от выбора подходящей юрисдикции до подготовки и оформления необходимых документов. Наши эксперты обеспечат полное сопровождение на каждом этапе, гарантируя безопасность и прозрачность сделки. Создайте крепкий фундамент для финансовой защиты и передачи капитала будущим поколениям. Свяжитесь с нами, и мы подберем для вас оптимальное решение!

Юридические консультации

В сферы юридического консалтинга мы оказываем следующие услуги:

- Международное налоговое планирование

- Подготовка Юридических заключений (legal opinions)

- Юридическое планирование и структурирование

- Подбор юрисдикции для бизнеса

- Юридические услуги для IT/IP

- Консультации по санкционному праву

- Консультации по спортивному праву

- Юридический консалтинг по ICO и блокчейн проектам

Юридические заключения

Юридическое заключение — это официальный документ, подготовленный юристом или юридической фирмой, который содержит профессиональный анализ и оценку правового аспекта конкретной ситуации, сделки, контракта или вопроса.

Цель юридического заключения — дать заказчику (клиенту) четкое понимание правовых рисков, возможностей и последствий, а также рекомендации по дальнейшим действиям, либо подтвердить или опровергнуть какой-либо факт.

Мы предоставляем:

- Комплексный анализ законодательства и нормативных актов.

- Подробное заключение с учетом рисков и рекомендаций.

- Решение нестандартных и сложных юридических вопросов.

- Гарантию точности и актуальности информации.

Юридические услуги для IT / IP

Статистика говорит, что 60% наших клиентов - это IT бизнес. Law&Trust предлагает специализированные услуги для IT-бизнеса и интеллектуальной собственности:

Что мы предлагаем:

- IT-контракты и соглашения: разработка и проверка договоров (SaaS, NDA, лицензии, договоры с разработчиками и клиентами).

- Регистрация и защита интеллектуальной собственности: патенты, товарные знаки, авторские права.

- GDPR и Compliance: помощь в соблюдении международных стандартов и законодательства в области обработки данных.

- Решение споров: защита ваших прав в спорах, связанных с IT и IP.

- Юридическое сопровождение стартапов: от регистрации компании до выхода на международные рынки.

Мы понимаем специфику IT-бизнеса и предлагаем решения, которые защитят ваши идеи, продукты и бизнес от юридических рисков.

Получение гражданства и релокация

Мы предлагаем комплексные услуги по получению вида на жительство (ВНЖ), постоянного места жительства (ПМЖ), гражданства и услуги по релокации в ведущих странах мира.

Что мы предлагаем:

- Подбор оптимальных программ для ваших целей (инвестиции, работа, учеба, воссоединение семьи).

- Получение гражданства через натурализацию, инвестиции или другие механизмы.

- Полное сопровождение на каждом этапе: от оформления документов до получения статуса.

- Решение сложных вопросов и минимизация риска отказа.

- Консультации по налоговому планированию и адаптации в новой стране.

Мы работаем с юрисдикциями по всему миру, включая страны ЕС, США, Ближний Восток, Азию, Карибский регион и другие. Наша команда экспертов обеспечивает надежность, прозрачность и конфиденциальность.

Международное налоговое планирование

Международное налоговое планирование: ваш ключ к финансовой эффективности Хотите снизить налоговую нагрузку и эффективно управлять финансами на международной арене? Наша юридическая компания предлагает профессиональные решения в области международного налогового планирования.

Мы помогаем:

- Оптимизировать налоговые платежи, сохраняя законность всех операций.

- Выбирать юрисдикции с выгодным налогообложением для бизнеса.

- Защищать активы и минимизировать финансовые риски.

- Разрабатывать индивидуальные и внедрять налоговые стратегии для масштабирования вашего бизнеса, с учетом юридических, налоговых и политических рисков для Вашей компании.

С нами вы получите комплексное сопровождение: от анализа текущей ситуации до внедрения продуманных налоговых решений, которые соответствуют законодательству.

18

years in business

3134

companies on service

1286

registered trademarks and patents

6243

happy customers

2456

bank accounts and merchant accounts

Our News

— Tatyana, hello! Please tell us about your role at Law&Trust Internati…

We officially declare that: We have never issued, do not issue, and cannot…

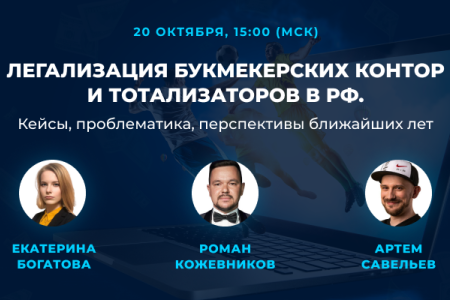

During the webinar, speakers will address topics relevant to legal represen…

In 2019, a number of international offshore jurisdictions faced a policy o…

Important notice: Law&Trust no longer operates in Russia. Law&Trus…

The European Commission has updated the list of countries that do not have…

After the explosive activity of 2017, crypto markets are experiencing sever…

Starting December 21, 2018, amendments to securities market legislation cam…

The U.S. Department of Justice's decision to expand the federal ban on onli…

The State Duma of the Russian Federation has adopted a bill on the automati…

Nakomoto News, a Russian company and partner of Law&Trust International…

About mandatory record-keeping for Dominica-based companies A compan…