Company Formation and Registration Services in Monaco (SAM)

Monaco - SAM :

registration of legal entity

Monaco - SAM

| Cost of registration | The cost of the second year | Number of Directors | Corporate tax rates | Payment of Charter Capital | Financial statements |

|---|---|---|---|---|---|

| 5380.00 EUR | 2660.00 EUR | 2 | 33.33% | 150000.00 | Yes |

Cost of registration Потому что...:

Потому что...:

Потому что...:

Потому что...: 5380.00

The cost of the second year:

2660.00

Company Registration in Monaco

Monaco was officially recognized as an independent state by the Franco-Monegasque Treaty of 1861, with Monaco becoming a full United Nations voting member in 1993. Monaco has the world's second-highest GDP nominal per capita, It also has an unemployment rate of 2%, according to the CIA World Factbook, Monaco has the world's lowest poverty rate and the highest number of millionaires and billionaires per capita in the world. Benefits Of Company Formation In Monaco

Business in Monaco: TaxesMonaco has high social insurance taxes, payable by both employers and employees. The employers' contributions are between 28% and 40% (averaging 35%) of gross salary, including benefits, and employees pay a further 10% to 14% (averaging 13%). However, Monaco is not a tax-free shelter; it charges nearly 20% value-added tax, collects stamp duties, and companies face a 33% tax on profits unless they can show that three-quarters of profits are generated within the principality. All companies incorporated in Monaco must also register for VAT. Bookkeeping in MonacoThe Bookkeeping Laws in MonacoCompanies incorporated in Monaco must lodge annual returns and tax returns. Tax returns are filed three months after the end of a fiscal year. Any tax due is immediately applicable. Tax losses can be carried forward (maximum of up to 5 years) and in certain cases, chargeback of losses for up to 3 years. Monaco companies must conduct the activity it declared during the registration and incorporation of the company submit a statement from the Balance Sheet annually. Copies of financial reports are kept in the company. It is also necessary to annually submit calculation on profit and loss, after auditing and approval by the auditor at the general annual meeting of shareholders. Features of S.A.R.L Company Formation in Monaco

Features of S.A.M Company Formation in Monaco

Requirements for Registration of a Company in Monaco

List Of Documents Required For Company Formation In MonacoIndividuals must provide the following requirements:

How to Register a Company in Monaco: the Process of RegistrationStep 1. Law and Trust works with the client to get the company’s name and activity approval from the Commercial Registry of the Principality of Monaco; Monaco Company Formation FAQs

The cost of registering a business in Monaco depends on the type of company and certain other factors. It starts at $5925. The total cost includes The total cost of registration includes a comprehensive review, company registration service, and certificate.

It takes from 60 days for company registration to be completed in the principality of Monaco.

It is not possible to start a business in Monaco without registration, a license is required to operate or run a business in Monaco.

It might not be necessary to visit Monaco to start a company, it is more important to get the required documents ready and the necessary requirements to incorporate a company in the principality.

Yes, it is required to have to a registered address in the principality of Monaco to complete company registration and formation process. Why Incorporate with Law&Trust International?Benefits of company registration, formation, and incorporation service with Law&Trust International in Monaco include:

Ready for Company Incorporation?If you are interested in registering and incorporating a company in Monaco, contact Law & Trust International by simply sending an email or call now to take your business to the next level! |

| Set of documents | |

|

|

| Nominee director and shareholder | |

| EUR |

|

General information

| Square | 2.00 |

| Population | 30 510.00 |

| Capital | Monaco |

| State polity | Constitutional monarchy |

| Telephone code | 377 |

| location | Western Europe |

| Climate | Mediterranean with mild, wet winters and hot, dry summers; avg. maximum temperature (July) +24°; avg. minimum temperature (January) +8° |

| Literacy rate | 99.00% |

| Ethnic groups | French 47%, Monegasque 16%, Italian 16%, other 21% |

| National currency | Euro |

| USD exchange rate | 0.75 |

| GDP per capita | 141 |

| Official language | French |

| Credit rating | A |

| The judiciary | Under the Constitution, the judicial power belongs to the Prince, which delegates its full local courts and tribunals. The judiciary includes magistrates, courts of first instance, appeal and cassation courts, the Supreme Court |

| Executive authority | Government Council, headed by the Minister of State |

| Legislative authorities | Prince and the National Council (parliament), consisting of 18 deputies elected for five years by direct vote |

| Opportunity to purchase ready-made companies | No |

| Legal system | Civil Law |

| The use of the Cyrillic alphabet in the name | No |

| Local registered office | Yes |

| Organizational and Legal Forms | SOCIETE ANONYME MONEGASQUE (SAM) BRANCH SOCIETE EN NOM COLLECTIF SOCIETE EN COMMANDITE SIMPLE SOCIETE A RESPONSABILITE LIMITEE (SARL) TRUSTS FOUNDATION |

| Indication of BPA in the name | SOCIETE ANONYME MONEGASQUE, S.A.M. |

| Local registered agent | Yes |

| Information about the beneficiary is disclosed | 150000 |

| The minimum amount of paid-in capital, nat. currency | 150000 |

| The minimum amount of the issued capital | 150000 |

| Bearer shares | No |

| Terms of payment of the issued capital | When registering |

| Possibility to issue shares without par value | No |

| VAT | No |

| Basic corporate tax rate | 33.33% |

| Capital gains tax | No |

| Currency control | No |

| Corporate tax rates details | When levied, the rate of business profits tax is 33.33%. Reduced rates apply to newly incorporated entities: a new trading entity less than 50% of whose share capital is held directly or indirectly by other companies pays a reduced rate of business profit |

| Stamp duty | No |

| Minimum number of directors | 2 |

| The requirement for residency directors | Yes |

| Director of legal entities are allowed | Yes |

| The data reveals to the local agent | Yes |

| Data field to the public registry | Yes |

| The requirement for the presence of the Secretary | No |

| Requirement to the residense of the Secretary | No |

| Requirements to qualification of the Secretary | No |

| Legal entity as the Secretary | No |

| Minimum number of shareholders | 2 |

| Data is entered in the public register | Yes |

| Shareholders residency requirement | No |

| Information about the beneficiary is disclosed | Yes |

| Information may be disclosed to the local agent | Yes |

| Shareholders-legal entities are acceptable | Yes |

| The requirement for filing reports | Yes |

| Open access to reports | No |

| Statutory audit | No |

| The requirement for filing Annual Return | No |

| Open access to the Annual Return | No |

| The requirement for reports | Yes |

| Treaty on avoidance of double taxation (States which signed) | 12 |

| Membership in the OECD | No |

| Is it offshore according to Russian legislation | Yes |

TM Comprehensive Study

First Class

Additional Class

220.00 EURN/A

TM Registration Request

First Class

Additional Class

570.00 EUR

80.00 EUR

TM Registration Certificate

First Class

Additional Class

0.00

0.00

Total

First Class

Additional Class

790.00 EUR

80.00 EUR

| TM Comprehensive Study | TM Registration Request | TM Registration Certificate | Total | ||||

|---|---|---|---|---|---|---|---|

| First Class | Additional Class | First Class | Additional Class | First Class | Additional Class | First Class | Additional Class |

| 220.00 | N/A | 570.00 | 80.00 | 0.00 | 0.00 | 790.00 EUR | 80.00 EUR |

| «TRADEMARK» refers to «Wordmark», «Logo» or «Wordmark + Logo» | |||||||

Prices include all professional and official fees. If the change of official duties or exchange rates prices may vary. In Monaco, the trademark registration fee includes 3 classes. After the third class, an additional fee will apply. Prices are calculated so that the description of the product / service can contain only 100 words. If the description is longer, you will need to pay 35 USD for each additional 100 words. A comparative check is carried out only for the verbal part of the Trademark. | |||||||

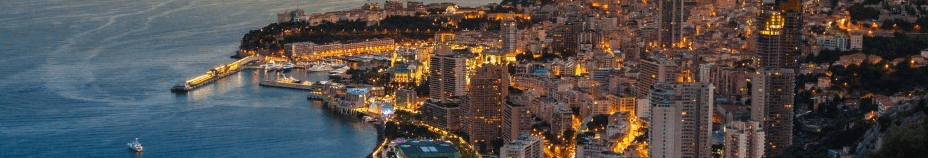

Monaco (officially known as the Principality of Monaco) is a principality state or country located on the French Riviera in Western Europe. Monaco is bordered by France, and the Mediterranean sea on the southern coast of France, near the border with Italy. Monaco is a principality under a constitutional monarchy. The population of Monaco is over 38000 (Thirty-eight thousand) people. The official language is French, but Monégasque, Italian, and English are widely spoken and understood in the principality.

Monaco (officially known as the Principality of Monaco) is a principality state or country located on the French Riviera in Western Europe. Monaco is bordered by France, and the Mediterranean sea on the southern coast of France, near the border with Italy. Monaco is a principality under a constitutional monarchy. The population of Monaco is over 38000 (Thirty-eight thousand) people. The official language is French, but Monégasque, Italian, and English are widely spoken and understood in the principality.