Cost of registration

from 11570 EUR

The cost of the second year

from 9600 EUR

Table of contents

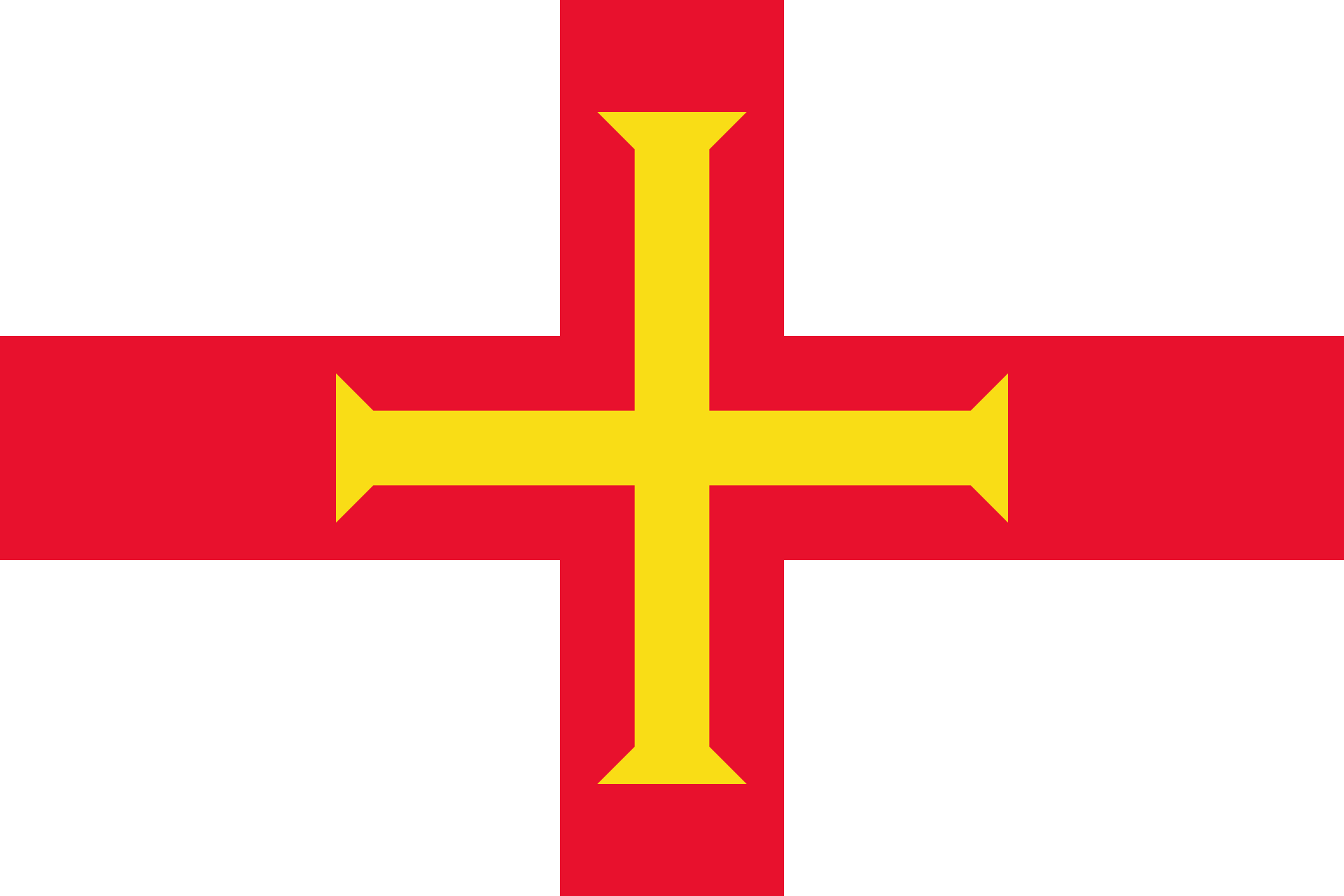

Registration of a company in Guernsey

Guernsey is one of the largest British Channel Islands, known for its almost regular triangular shape and its proximity to Normandy (merely 48 km). England is 130 km from the island with the area of 65 km2.

There is no extreme difference in elevations in the relief of Guernsey. The ascent from the northern plateau to the southwest cliffs is quite smooth. Considering moderate climate of the island, severe frosts and snowy weather are very rare.

The main city of Guernsey is Saint Peter Port. The residents of the island (British and French people) live there and the amount of population is approximately 58 thousand people. English is the official language. At the same time, French (for example, in the Royal Court of Guernsey) is widely used.

The pound sterling is the official currency of Guernsey (GBP). there is no currency control on the island.

Financial services and tourism are the two main income items for the islanders. Fishing and agriculture are also of particular importance.

Perfectly balanced air transport system connects Guernsey with many European centers. Water transport is primarily used for the import of various materials and goods. Telecommunication of the island is based on the UK digital network.

Many people tend to register business in Guernsey. One of the main reasons is favourable location of the island close to Great Britain and Europe. In addition, the principles of taxation adopted for the EU do not apply to Guernsey.

Company registration in Guernsey

According to corporate legislation of the Guernsey island, it is possible to register joint-stock company with limited liability in the state. The type of company can be public and private.

All companies in Guernsey are divided into two types:

- Resident;

- Non-resident (exempt).

From January 1, 2019, keep cash and assets or conduct business with the help of companies in Genrs without having a “presence” (substance), i.e. The actual management of a company from Guernsey is impossible for companies. Who are engaged in:

- Banking;

- Insurance;

- Transportation;

- Asset management;

- Financing and leasing;

- Company management (Headquarters, headquarters);

- Provide distribution services and service centers;

- They are holding companies; and

- Whose assets consist primarily of intellectual property.

The main requirements for such companies can be formulated as follows:

- The presence of qualified personnel in the territory of the jurisdiction, the number and qualification of which corresponds to the activities of the company;

- Availability of office and equipment in the territory of jurisdiction, the area and other characteristics of which correspond to the company's activities;

- Adequate level of costs incurred in the relevant jurisdiction to support the activities of the company.

From 2019, companies will have to very carefully structure their activities in view of the fact that, due to the mandatory Substance, there is a risk of applying the income tax rate of 20%.

Peculiarities of the exempt company in Guernsey

- Owners can not be residents of the island and conduct business activities with residents of Guernsey or entities registered in the jurisdiction.

- Confidentiality in relation to the company itself is not the requirement of the charter. At the same time, the specialists of the registration authorities observe the principle of confidentiality regarding the activities of clients.

- It is prohibited to conduct trade or any other activity on the island, which is related to insurance, financial and banking spheres.

- The Charter and the Memorandum of Association of the company shall be submitted to the Commission, which reports to the financial service. Information regarding the registered address of the office (only within the territory of the island), as well as names, addresses, citizenship of shareholders and directors is transmitted. In addition, the information about the present owners of the company and detailed description of the planned activities (commercial and/or investment) of the company are necessary.

- It is impossible to register ready-made company in Guernsey, because of the requirement to provide notification of real ownership.

Company name in Guernsey

- When selecting the name for the company, it is necessary to refer to the following:

- In order to affirm the name of the company, it is necessary to file official request with the Financial Service Commission;

- The meaning of the name shall be defined for jurisdiction authorities. Therefore, the name can be prepared in any language and using the Roman alphabet;

- It is prohibited to use existing or identical company names;

- The names of famous multinational companies can not be used without prior agreement in writing;

- It is unacceptable to use the names implying illegal types of activities;

- The reference to government or royal patronage in the name is prohibited;

- The use of such words and their equivalents in other languages as Reinsurance, Guernsey, Bank, Savings, Loans, Insurance, Assurance, Chamber of Commerce, Council, Co-operative, Building Society, Trust, Finance, Trustees, International requires additional coordination or obtaining special license;

- The word Limited or its abbreviated form Ltd (French equivalents are also admitted) should be at the end of the company name.

Miscellaneous requirements

- It is necessary to have at least one director (legal entity), who can be non-resident of Guernsey.

- The company should have secretary, and there are no requirements regarding his citizenship and status.

- The company can conduct activities with at least two shareholders (corporate shareholders are also possible). Data concerning the owners of the company submitted to the authorities of Guernsey are confidential.

- The register of shares is kept at the place of registration of the office of the company.

- The issued shares should be paid in cash. The permitted types of shares are the following:

- registered shares,

- preferred shares,

- redeemable shares,

- irredeemable shares,

- non-voting shares, as well as shares providing the right to vote for the owner.

Issue of bearer shares is not provided for.

Taxation in Guernsey

The exempt company is not taxed, but pays corporate fee, regardless of income (GBP 500 per year).

The company's registration in Guernsey provides for submission of annual report containing information about shareholders and directors of the company. It shall also indicate all the changes occurred in the composition of the management from the date of submission of the last report. The fee in the amount of GBP 100 is paid for putting the report on the state register. The company pays penalty for untimely submitted report.

The cost of the company's maintenance also includes the submission of the required annual reporting.

Do you want to register company in Guernsey? Then feel free to contact us. Registration of the company in Guernsey will turn up simple and pleasant matter for you. Registration of companies (offshore companies) in various jurisdictions of the world is one of the most important directions of our work.