Cost of registration

from 9750 EUR

The cost of the second year

from 8790 EUR

Table of contents

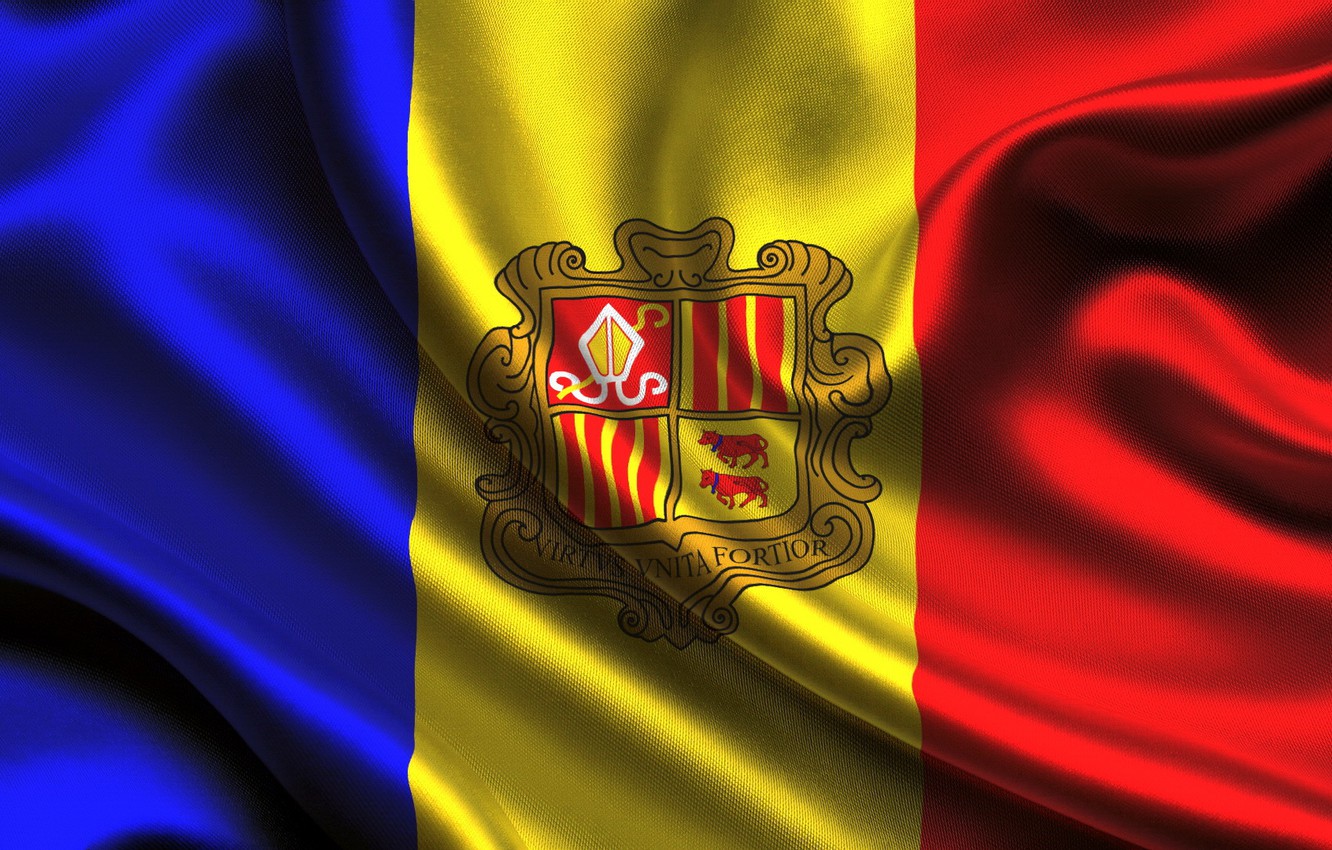

Andorra officially known as the Principality of Andorra is a landlocked principality bordered by France to the north and Spain to the south. The population of Andorra is just over 80 thousand. Andorra is a parliamentary co-principality, two princes jointly sharing the title of a prince with neither a citizen of Andorra. One is the President of France (Emmanuel Macron), and the other co-prince is the Bishop of Urgell (Joan Enric Vives i Sicilia). The princes work together and not independently. Andorra is divided into 7 (seven) territorial units which are called parishes. Its official language is Catalan. Spanish, Portuguese and French is also spoken. The Euro is its official currency with Andorra, well known for its tobacco and tourism.

Andorra still has a parliamentary democracy (semi-elective diarchy) with the seat of a Prime Minister. Andorra is the sixth and sixteenth smallest country in Europe and the world respectively by land mass. The capital of Andorra is Andorra la Vella. Andorra is a member of the United Nations and the Council of Europe. The authority responsible for company formation in Andorra is the Registre de Societats Mercantils.

Benefits of Company Formation in Andorra

- The low corporate tax rate.

- Reduced corporate tax on profits (companies involved in the international management of intangibles).

- Lower labour costs.

- Double taxation treaties signed with 12 countries.

Business in Andorra: Taxes

Low corporate tax - a maximum of 10%.

VAT rate - 4.5%

No capital gains tax.

Bookkeeping in Andorra

Statutory audit - No.

Annual return filing - No.

Filing report requirement - Yes.

Registration of the company in Andorra: Types of Companies

- Societat Limitada (S.L.) - Limited Liability Company;

- Societat Anonima (S.A.) - Corporation company;

- Societat Colectiva (S.C.) - Unlimited liability Partnership;

- Sole Proprietorship.

Company Registration Requirements in Andorra

- Minimum number of directors is one;

- Minimum number of shareholders is two;

- Minimum share capital is €3000;

- A secretary is required;

- A local director is required (a local registered agent is required);

How to Register a Company in Andorra: The Registration Process

Step 1. Law and Trust works with the client to get the company’s name and activity approval from the Companies Registry of Andorra (Registre de Societats Mercantils);

Step 2. Law and Trust with the client to secure the Memorandum of Association (MOA);

Step 3. Law and Trust collects, prepares and files the necessary incorporation documents on behalf of the client to the relevant authorities for approval;

Step 4. Law and Trust works with the client to open a corporate bank account in Albania;

Step 5. Law and Trust deliver the certificate of incorporation personally to the client or via courier service.

Andorra Company Formation FAQs

How much does it cost to register a company in Andorra?

The cost of registering a company in Andorra is $7050. the total cost includes the preparation of legal documents, company registration, payment of all taxes and fees at the time of registration and legal address for the company (a year).

How long does it take to register a company in Andorra?

It takes from four weeks to complete the company registration process in Andorra.

Can I start a business without registering it in Andorra?

It is not possible to start a business in Andorra without registration, a license is required to operate or run a business in Andorra.

Do I need a local address to register a company in Andorra?

Yes, it is required to have to a registered address in Andorra to complete the necessary company registration and formation process.

How can I register a company name in Andorra?

The registration of a company name begins with the filing of the appropriate documents, Law&Trust helps with preparation and compilation of the necessary documents ensuring it meets the requirements set out by the companies registry with regards to the approval of a company name.

WHY INCORPORATE WITH LAW&TRUST INTERNATIONAL?

Benefits of company registration, formation, and incorporation service with Law&Trust International in Andorra include:

Full range of related services: Provision of a full range of legal, corporate, government, and business intelligence related services in Andorra. A detailed overview of our services includes full legal support of the company registration procedure, obtaining a legal address, interaction with the official government authorities of the jurisdiction, state fees, legal address of the company for a year, production and registration of company stamps and advising the client as part of the registration process. Opening a bank account and the cost of this service are discussed during the consultation.

Professionals and expertise of Law: Worldwide registration and legal maintenance of companies, accounting services, and audit, tax planning and optimization, trademark and patent registration. Law and Trust provide the client with the best company incorporation services.

Domestic service: Law&Trust ensure our services cover every region, area or state in Andorra. Be rest assured that no matter where the new company intends to incorporate in the principality of Andorra, we’ve got the location covered.

Free initial advice: Free consultation from the lawyers of Law&Trust International regarding strategies or the provision of services for analyzing and developing a legal position on an issue the client raises in Andorra.

Confidentiality: Law&Trust makes use of modern technological features to keep the records and details of every client safe.

Efficiency and productivity: Strategically providing up to date personalized services to help your business succeed.

READY FOR COMPANY INCORPORATION?

If you are interested in registering and incorporating a company in Andorra, contact Law & Trust International by simply sending an email or call now to take your business to the next level!