Company Formation And Registration Services In Ireland

Ireland :

registration of legal entity

Ireland

| Cost of registration | The cost of the second year | Number of Directors | Corporate tax rates | Payment of Charter Capital | Financial statements |

|---|---|---|---|---|---|

| 1975.00 EUR | 1725.00 EUR | 1 | 12,5% (0% для некоторых компаний до 2021 года) | 0.00 | Yes |

Cost of registration Потому что...:

Потому что...:

Потому что...:

Потому что...: 1975.00

The cost of the second year:

1725.00

Company Formation In Ireland

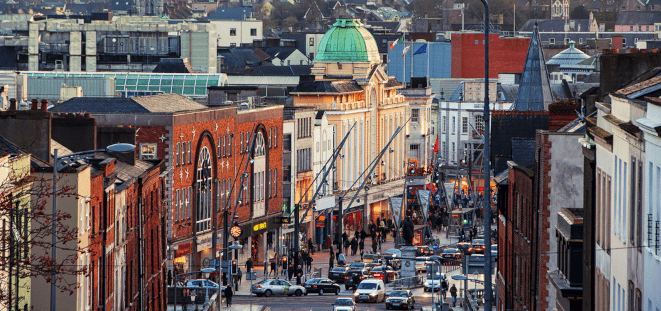

The republic of Ireland is a nation located in the northwestern part of Europe (island) or the North Atlantic ocean, it is bordered to the east by the North channel, the Irish sea and St. George’s channel. It is the second largest Ireland of the British Isles and the third largest in Europe. The population of the Republic of Ireland is about 6.6 million people, its largest city and capital is Dublin. The official language is English and Irish. The landscape of Ireland is represented by lowlands in the north and central part of the country, mountains in the south-west with the Irish Kerry Mountains situated there. Hence, the nickname ‘The Emerald Isle’ due to its lush vegetation and rolling hills. Ireland is notable for its unstable weather: there are frequent rains, winds and fogs. This is due to the moderate oceanic climate of the country. The Companies Registration Office is responsible for the registration and incorporation of companies in the Republic of Ireland. ADVANTAGES OF STARTING A BUSINESS IN IRELAND

STARTING A COMPANY IN IRELAND: TAXESCorporate income tax: for trading companies - 12.5% It is important to note that there is a 25% tax credit on qualifying R&D expenses, summing up to a total effective tax deduction of 37.5%. In addition, under the Knowledge Development Box, a reduced corporate tax rate of 6.27% applies to certain profits arising from assets derived from R&D initiatives. Certain start-ups may benefit from a tax relief for three years, if the total amount of corporate tax payable does not exceed EUR 40,000 in each year. REQUIREMENTS FOR REGISTRATION OF COMPANY

DOCUMENTS REQUIRED TO REGISTER A COMPANYThe following are the document required for setting up a business in Ireland:

PROCESS OF SETTING UP A COMPANY IN IRELANDThe registration process begins with a free consultation and expert assessment from our lawyers, ensuring it complies with the requirements of a new company registration. After which, our specialists collect, prepare the necessary documents and submit the application for company registration. At the end of the registration procedure, the certificate of Incorporation may be delivered to you via courier service or an email addressed by the founders of the company. Company registration/incorporation gives operational and transactional rights in the republic of Ireland but not in Northern Ireland. REGISTER A BUSINESS IN IRELAND: TYPES OF COMPANIESThe following are the business types that can be registered in Ireland, they include:

- Private Company Limited by Shares (LTD)

IRISH COMPANY FORMATION FAQs

The cost of registering a company in Ireland is $1975. The total cost of the registration includes comprehensive review, company registration service and certificate.

It takes about two to three weeks to register a company in Ireland.

Contact Law and Trust International, our Lawyers get in touch with the ‘Companies Registration Office’, working with them closely to verify the registration of a business or company.

The company registration number is a unique number issued when a limited company or limited liability partnership is incorporated in the territory of Ireland.

CRN (Company registration number) consists of six numbers. These are unique numbers given by the CRO to identify a company and confirm that it is indeed a registered legal entity.

Registering a company for VAT in the Republic of Ireland are dependent on what goods or services your business provides. Law and Trust International works with the Companies Registration Office for your companies VAT registration. WHY INCORPORATE WITH LAW&TRUST INTERNATIONAL?Benefits of Ireland company incorporation and registration with Law&Trust International team include:

READY FOR COMPANY INCORPORATION?If you are interested in registering and incorporating a company in the Republic of Ireland, Law & Trust International can help. Simply send us an email or call now to take your business to the next level! |

| Set of documents | |

|

|

| Nominee director and shareholder | |

| EUR |

|

General information

| Square | 70 273.00 |

| Population | 4 722 030.00 |

| Capital | Dublin |

| Unemployment | 24.30 |

| State polity | Republic, parliamentary democracy |

| Telephone code | 353 |

| Place in the world in corruption | 19 |

| location | Western Europe, occupying five-sixths of the island of Ireland in the North Atlantic Ocean, west of Great Britain |

| Climate | Temperate maritime; modified by North Atlantic Current; mild winters, cool summers; consistently humid; overcast about half the time; avg. maximum temperature (July) +17°; avg. minimum temperature (January) +4° |

| Literacy rate | 99.00% |

| Ethnic groups | Irish 87.4%, others white 7.5%, Asian 1.3%, colored 1.1%, mixed 1.1%, others 1.6% |

| National currency | Euro |

| USD exchange rate | 0.75 |

| GDP per capita | 24 |

| Official language | English (official) is the language generally used, Irish (Gaelic or Gaeilge) (official) spoken mainly in areas along the western coast |

| Credit rating | AA |

| The judiciary | Supreme Court (court of last resort), the trial courts, including the Supreme Court |

| Executive authority | Head of government: Prime Minister. Cabinet: Cabinet appointed by the president to the prime minister and approved by the lower house of parliament |

| Legislative authorities | bicameral Parliament: the Senate (60 seats) and the House of Representatives (166 seats) |

| Opportunity to purchase ready-made companies | Yes |

| Legal system | Common Law based on English Common Law |

| The use of the Cyrillic alphabet in the name | No |

| Local registered office | Yes |

| Organizational and Legal Forms | Private limited company (LTD), Designated Activity Company (DAC), Company Limited by Guarantee having a Share Capital (DAC limited by guarantee), Company Limited by Guarantee not having a Share Capital (CLG), Public Limited Company (PLC), Unlimited Companies, Investment Funds, Partnerships. |

| Indication of BPA in the name | Teoranta (Gaelic equivalent Limited), Limited or the abbreviation Ltd. |

| Local registered agent | No |

| Standard currency | EUR |

| The minimum amount of paid-in capital, nat. currency | Not applicable |

| The minimum amount of the issued capital | 1 |

| Bearer shares | No |

| Terms of payment of the issued capital | When registering |

| The usual size of the authorized capital | EUR 100,000 |

| Usual nominal value of shares | 1 Euro |

| Possibility to issue shares without par value | No |

| VAT | Yes |

| Basic corporate tax rate | 12,5% (0% для некоторых компаний до 2021 года) |

| Capital gains tax | No |

| Currency control | No |

| Corporate tax rates details | 12,5% for Trading Income, 25% - Non-trading income |

| Stamp duty | No |

| Other taxes | VAT 23% |

| Minimum number of directors | 1 |

| The requirement for residency directors | Yes |

| Director of legal entities are allowed | Yes |

| The data reveals to the local agent | Yes |

| Data field to the public registry | Yes |

| The requirement for the presence of the Secretary | Yes |

| Requirement to the residense of the Secretary | No |

| Requirements to qualification of the Secretary | No |

| Legal entity as the Secretary | No |

| Minimum number of shareholders | 1 |

| Data is entered in the public register | Yes |

| Shareholders residency requirement | No |

| Information about the beneficiary is disclosed | No |

| Information may be disclosed to the local agent | No |

| Shareholders-legal entities are acceptable | Yes |

| The requirement for filing reports | Yes |

| Open access to reports | No |

| Statutory audit | Yes |

| The requirement for filing Annual Return | No |

| Open access to the Annual Return | Yes |

| The requirement for reports | Yes |

| Treaty on avoidance of double taxation (States which signed) | 74 |

| Membership in the OECD | Yes |

| Is it offshore according to Russian legislation | No |

TM Comprehensive Study

First Class

Additional Class

122.40 EUR65.70 EUR

TM Registration Request

First Class

Additional Class

612.90 EUR

207.00 EUR

TM Registration Certificate

First Class

Additional Class

633.60

0.00

Total

First Class

Additional Class

1368.90 EUR

272.70 EUR

| TM Comprehensive Study | TM Registration Request | TM Registration Certificate | Total | ||||

|---|---|---|---|---|---|---|---|

| First Class | Additional Class | First Class | Additional Class | First Class | Additional Class | First Class | Additional Class |

| 122.40 | 65.70 | 612.90 | 207.00 | 633.60 | 0.00 | 1368.90 EUR | 272.70 EUR |

| «TRADEMARK» refers to «Wordmark» or «Logo» | |||||||

| 219.60 | 101.70 | 612.90 | 207.00 | 633.60 | 0.00 | 1368.90 EUR | 308.70 EUR |

| «TRADEMARK» refers to «Wordmark+ Logo» | |||||||

Prices include all professional and official fees. If the change of official duties or exchange rates prices may vary. Цены включают в себя все юридические и официальные сборы. Наши цены могут иметь вариации в процессе регистрации только в случае изменений, касающихся официальных сборов или обменных курсов. | |||||||