Cost of registration

from 2890 EUR

The cost of the second year

from 1080 EUR

Table of contents

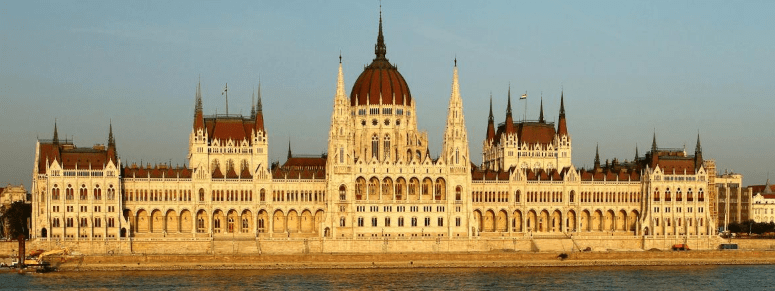

Registration of a Company in Hungary

Hungary is a country located in central Europe. It borders Slovakia to the north, Ukraine to the northeast, Austria to the northwest, Romania to the east, Serbia to the south, Croatia to the southwest, and Slovenia to the west. The population of the country is about 10 million, Hungary’s capital and largest city is Budapest. Hungary became a part of the European union in 2004. it is a medium sized open economy in central Europe. Its official language is Hungarian, which is the most widely spoken Uralic language in the world. Forint is the monetary unit of the country.

The primary act of law in Hungarian company law is Act 4 of 2006 on Business Associations (Companies Act). The main types of business associations under the Companies Act are identical to those regulated in EU countries. The procedures on founding, implementing changes in data and winding up of Hungarian associations are primarily governed by Act V of 2006 on Public Company Information, Company Registration and Winding-up Proceedings (Company Procedures Act).

Advantages of Company Formation in Hungary

- Low Corporate Tax rates

- No requirements to appoint a citizen as a shareholder or director,companies can be fully owned and controlled by international directors and shareholders.

- The corporate law is very transparent and understandable.

- A very efficient banking system.

- Proof of status of the taxpayers at the registration place.

Setting up a business in Hungary: Taxes

The corporate tax rate in Hungary is one of the lowest in Europe. It ranges form 10% to 16%.

Registration of an offshore company is not feasible in Hungary, as companies are required to pay tax on profits earned.

Requirements to Register a Company in Hungary

The requirements needed in registering a company in Hungary include the following:

- A registered address - a legal address and contact is needed;

- Article of foundation or incorporation;

- List of shareholders;

- Hungarian bank account - All Hungarian companies are required by law to have a bank account opened within the first week of the company incorporation;

- An accountant is required - They are part of the company formation agents as they will e responsible for the submission of periodic reports to the Tax office, Statistics Bureau and several other authorities.

Registration of a Business in Hungary: Types of Companies

The following are the types of business entities that can be registered in Hungary, they include:

- Limited Liability Company (Kft.)

- General Partnership (kkt)

- Limited Partnership (Bt)

- Private company limited by shares (Zrt)

- Public company limited by shares (Nyrt)

- Joint Stock company (Rt.)

- Branch office (Fa.)

- Representative office (K.i.)

Characteristics of a Limited Liability Company (Kft) in Hungary

- Amount of authorized capital starts from 3,000,000 HUF. 50% of the total amount must be paid at the time of registration.

- Monetary assets and the payments involving other assets, their value should be assessed by independent expert from Hungary.

- The companies can have shareholders whose liability is limited by shares in the capital of the established company.

- Status and residency of the shareholders do not matter.

- Shares can not be put on public sale.

- Even one director - a legal entity - can run the company.

- Company with capital of more than 50 million forints and staff composition of more than 200 people should elect the Supervisory Board.

Characteristics of Joint Stock Company (Rt) in Hungary

- Amount of authorized capital is from 20 million forints. 30% of the amount should be paid at the time of registration.

- Monetary assets and the other assets, their value should be assessed by independent expert from Hungary.

- The number of shareholders is not limited. Responsibility is defined by shares of shareholders.

- Status and residency of the shareholders do not matter.

- Registered and bearer shares are allowed, and they can be issued on public sale.

- The Board of Directors comprise 3-11 members. Legal entities can not be directors.

- Monitoring the work is performed by the Supervisory Board.

Characteristics of General Partnership (Kkt) in Hungary

- Amount of minimum capital is not fixed.

- Capital is allocated evenly between all shareholders.

- Partnership is established by at least two partners.

- Equality of the partners is declared. They are responsible for the debts and commitments on equal terms and unrestrictedly.

- Status and residency of the shareholders do not matter.

- Transfer of shares to third parties is prohibited without the general meeting’s decision.

- Management is carried out by the general partners in accordance with the provisions of the Constituent Treaty.

Characteristics of Limited Partnership (Bt) in Hungary

- Amount of minimum capital is not fixed.

- Capital is distributed evenly among all owners of the shares.

- Partnership is established with a minimum of at least two partners.

- Status and residency of the shareholders do not matter.

- There are two types of partners: general and limited.

- Equality of the partners is declared. They are responsible for the debts and commitments on equal terms and unrestrictedly.

- Limited partners have limited liability within their shares.

- Transfer of shares to third parties is prohibited without the general meeting’s decision.

- Management is carried out by the general partners in accordance with the provisions of the Constituent Treaty.

Process of Hungarian Company Incorporation

The registration process begins with a free consultation and expert assessment from our lawyers, ensuring it complies with the requirements of a new company registration. After which, our specialists collect, prepare the necessary documents and submit the application for company registration. At the end of the registration procedure, the certificate of Incorporation may be delivered to you via courier service or an email provided by the founders of the company. Company registration and incorporation gives operational and transactional rights in Hungary.

Hungarian Company Incorporation FAQs

- Where to register a company in Hungary?

The authority responsible for company incorporation and formation in Hungary is the Hungarian Court of Registry. Law and Trust International works with the authorities closely in the company registration process.

- How much does it cost to register a company in Hungary?

The cost of registering a company in Hungary costs $1990. The total cost of registration includes comprehensive review, company registration, service and certificate.

- How long does it take to register a company in Hungary?

Registering a company in Hungary takes from a week to four weeks to complete the process as it depends on the business entity

- How to register a foreign company in Hungary?

Registering a foreign company or overseas company in Hungary has to conform with the requirements set out by the Hungarian Court of Registry. Contact Law and Trust International to get a professional view on registering a foreign company in Hungary.

- How to register a trust company in Hungary?

Registering a trust company in Hungary is not a feasible option. Contact Law and trust International, our Lawyers will give you detailed reasons on why trust companies aren’t registered in Hungary.

Why Incorporate with Law&Trust International?

Benefits of business incorporation in Hungary with the Law&Trust International team include:

- Full range of related services: Provision of a full range of legal, corporate, government, and business intelligence related services.

- Professionals and expertise of Law: Worldwide registration and legal maintenance of companies, accounting services and audit, tax planning and optimization, trademark and patent registration, and many more. Best professionals are always available to help your business.

- Thorough domestic service: Law &Trust ensure our services cover every region in Hungary. No matter where you decide, be rest assured we got the location covered.

- Free initial advice: Company formation advisors, lawyers of Law and Trust provide free initial advice, as well as services for analyzing and developing a legal position on the issue you have raised.

- Fast and safe: Law&Trust keeps every clients’ details secured.

- Efficiency and productivity: Strategically providing up to date personalized services to help your business succeed.

Ready for Company Incorporation?

If you are interested in registering and incorporating a company in Hungary, Law & Trust International can help. Simply send us an email or call now to take your business to the next level!