Cost of registration

from 2250 USD

The cost of the second year

from 1900 USD

Table of contents

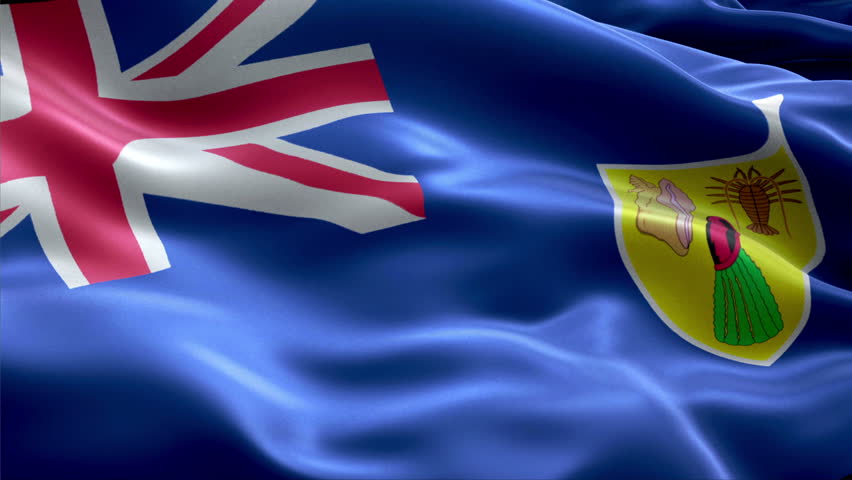

How to register company on the Turks and Caicos Islands

The Turks and Caicos Islands are located in the northern sector of the Atlantic Ocean, east of the Bahamas.

The area of the state is 430 km2.

The islands are inhabited by over 20 thousand people.

The capital is the city of Cockburn Town.

The official language is English.

The monetary unit of the islands is the US dollar.

The legal system of the Turks and Caicos Islands is based on the legislation of England and Wales. Insignificant amendments were made to it based on the legislation of Jamaica and the Bahamas. The islands signed the Hague Convention of 1961.

The basis of the country's economy is tourism sector, fishing, and provision of offshore services.

Food products and manufactured goods are predominantly imported.

Why is it advantageous to register or buy offshore company on the Turks and Caicos Islands

- The company is fully exempted from taxes;

- The owners are provided with high confidentiality (the register of directors and shareholders is closed);

- There is the possibility to use nominal services;

- There are no requirements to submit reports;

- There is no currency control.

Special attention is given to maintenance of confidentiality on the islands (the Decree on confidential relationships). Thus, according to the Decree, the disclosure of information by lawyers and other professionals in the field of corporate activities is prosecuted by law and in certain cases can entail not only the imposition of penalties, but also imprisonment.

The legislative framework on the Turks and Caicos Islands

Registration and activities of offshore company on the Turks and Caicos Islands are governed by the Companies Ordinance Act of 1981, as amended.

Forms of doing business on the Turks and Caicos Islands

Entrepreneurs who tend to be engaged in international business and investments prefer to register Exempt/International Business Company (IBC).

Registration of offshore companies on the Turks and Caicos Islands. Basic provisions

- The company can conduct any activity permitted by law.

- Offshore company on the Turks and Caicos Islands shall have registered office and registration agent.

- The end of the company’s name should contain such word as Sociedad Anónima or such abbreviation as S.A.

- The authorized capital is not required to be paid. The amount shall equal to $ 5000.

- The company can issue bearer shares and shares without par value.

- The minimum number of shareholders of S.A. company is 1 person (natural or legal person).

- The minimum number of directors of S.A. company is 1 person (natural or legal person).

- Nominee directors and shareholders are allowed.

- Information about the owners of the company, as well as the shareholders can be disclosed only by the court decision.

- Meetings of shareholders / directors shall be held anywhere in the world.

- There are no requirements concerning place of storage of the company’s documents.

- There is no currency control on the islands.

- After submitting all the documents, the registration of offshore company on the Turks and Caicos Islands is completed upon the expiry of two weeks.

The registration procedure includes the following stages:

- Verification and confirmation of the name of the company in the register.

- Preparation and filling of relevant documents.

- Payment of all necessary registration fees, and duties.

- Incorporation of the company into the Company's Register.

- Notarial certification.

Bookkeeping on the Turks and Caicos Islands

Offshore company on the Turks and Caicos Islands does not maintain accounting records and does not compile annual reports.

Taxes on the Turks and Caicos Islands.

The IBC is completely exempt from taxes.

We will register company (offshore company) on the Turks and Caicos Islands for you within the shortest time possible. Buy offshore company on the Turks and Caicos Islands at a low price is now easier than ever. Registration of offshore company on the Turks and Caicos Islands is one of the simplest and cheapest ways to start legitimate international business. Offshore registration is one of the main directions of our company's work.

Set of corporate documents

- Certificate of incorporation

- Articles of incorporation

- Resolution of the subscriber

- Minutes of the first Meeting of Directors

- Share Certiciates

- Certificate of Exemption from Future Taxation

- Page with Apostille