Cost of registration

from 1185 USD

The cost of the second year

from 900 USD

Table of contents

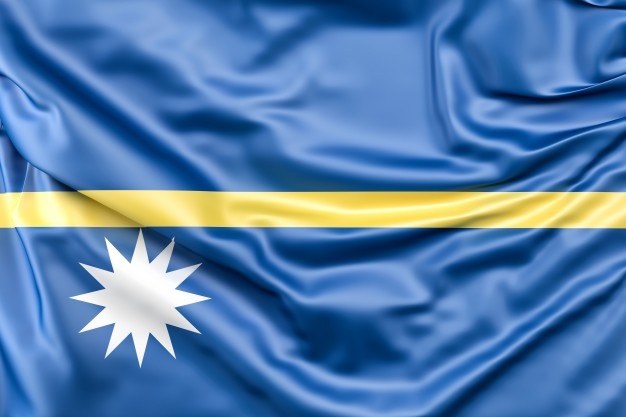

Nauru is the smallest independent republic in the world, the smallest island nation, and the smallest state located outside of Europe. But Republic is unique not only due to abovementioned facts, it is also known as the country (the one and only in the world) without capital.

Nauru is situated in the Pacific Ocean. The area of the republic is 21,3 km2. The population is approximately 10 thousand people. Nauru island is located 42 km south of the equator. The nearest island to Nauru is Banaba.

The most widespread language in Nauru is English

According to its political structure, Nauru is a parliamentary republic. The monetary unit of the republic is the Australian dollar. Yaren District acts as the capital of Nauru. A bit less than half of the country’s population lives there.

In geological terms, Nauru is a coral atoll formed millions of years ago. There are no rivers in Nauru, and the only lake also contains no freshwater. Therefore, seawater is desalinated in order to provide the residents with drinking water. The harvested rainwater is used for economic purposes.

The climate of the island is hot and humid.

Nauru is member of the UN, the Commonwealth of Nations, the Pacific Islands Forum and others organizations.

If you intend to buy or register offshore company in Nauru, pay attention to the fact that the Republic of Nauru is currently not included in the "black list" of the international organization FATF.

Registration of offshore companies in Nauru is becoming more and more popular due to the absence of taxes for international business.

Forms of doing business

Offshore company in Nauru is registered in the form of the International Business Company (IBC).

The legislative framework.

The offshore companies’ activities in Nauru are regulated by the Law “On International Business Companies”.

Registration of offshore companies in Nauru - key features

- The company can conduct any activity permitted by law. Banking, insurance, reinsurance activities and services in the trust field require special license.

- Offshore company in Nauru has no right to conduct commerce with residents of the jurisdiction and own real estate in Nauru. In addition, the resident company can not participate in the management of offshore company. Provision of services of registration agent for offshore company in Nauru to resident companies is prohibited.

- Term of registration of business in Nauru usually equals to two business days from the moment when all the necessary documents are submitted to the registrar.

- Company name should be original and not similar to already existing names.

- The name can be registered in any language, but at the same time its translation into English is mandatory.

- In order to register it is necessary to provide Memorandum and Charter of the company.

- The Company shall have a legal address in the territory of Nauru. Correspondence from state authorities will come to this address. The address shall be provided by the registration agent.

- There is no standard for the authorized capital of the offshore companies in Nauru. But the amount should be declared. As a rule, the proposed amount of the authorized capital is $ 1000.

- Registered shares, bearer shares, par value shares and no par value shares, shares in any currency can be issued.

- Legal and natural persons, residents of any country can be shareholders and directors of the company.

- The company can have at least one director. All the rights in the company belong to him, except those that are within the competence of shareholders (all of the provisions are defined by the Charter, Memorandum of the company or by the law).

- Meetings of shareholders shall be held at any place selected by the participants, and it is possible to hold meetings using the telephone communication. There are no conditions concerning the place of storage of the meetings’ minutes.

- Confidentiality of information regarding directors and shareholders is guaranteed. In order to obtain the access to the data, a third party should receive the decision of the local court.

- Foundation documents are allowed to be stored in any country of the world.

- Selection of banks and number of accounts are not limited. All banking transactions are confidential.

- The law also permits to buy ready-made (registered) company in Nauru.

Taxes in Nauru

There is no income tax.

There is no capital gains tax.

Tax on distributed dividends is 0%.

Bookkeeping in Nauru

The company in Nauru is not obliged to maintain records and submit reports.

In order to register offshore company in Nauru, you only need to apply to us. Registration of companies in different parts of the world is one of the main directions of our work. You can start your successful international business from company formation in Nauru.