Licensing of an investment fund in Latvia

According to the EU Directive 2011/61/EC, a new form of investment management in the EU (an alternative manager) has been introduced. Management company, after licensing in the Commission for the Supervision of Financial Markets, de facto obtains the status of an investment fund licensed in the EU.

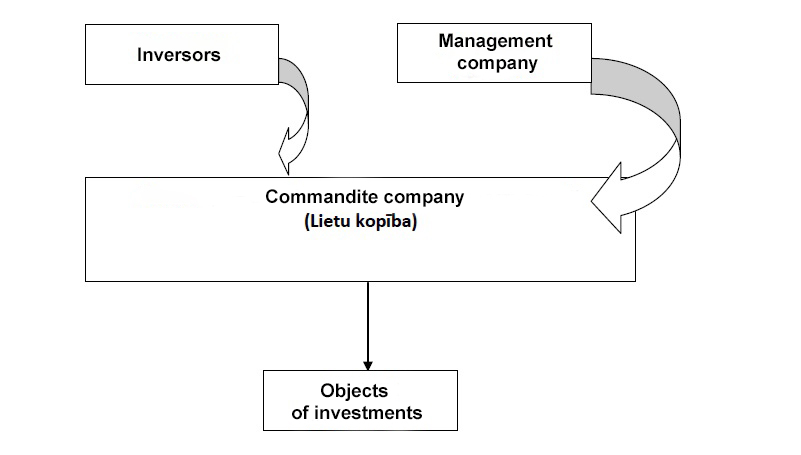

Below is the recommended structure of this fund (in Latvia):

1. The Agreement on the establishment of an investment fund is cocluded between the Management Company and Investors. Thus, an EU-licensed structure is created that can invest in different objects in the EU and the management of which is connected to the so-called external manager.

2. The Fund is created as closed (private) one and has no right to redeem shares or stakes back during the activity.

3. Functions of the Management Company:

- management of the investment fund;

- management of risk.

4. The manager has the right to distribute shares only to professional investors.

5. Depending on the investment strategy and the use of the leverage, the minimum authorized capital is determined.

If you are interested in licensing an investment fund in Latvia, now it's as simple as ever. With us, the process of licensing an investment fund in Latvia will become fast and efficient for you.

By applying for help to the specialists of Law&Trust International, you will get quality services at the best prices!