Trust, Foundation, Fund - main trends and jurisdictions in 2017

Trust, Foundation, Fund - main trends and jurisdictions in 2017

Introductory provisions:

- Client - a tax and currency resident;

- Assets - securities (shares and bonds);

- Asset Location - current and brokerage account of Swiss bank;

- Income - income in the form of dividends and coupon income are arrived in current account in Swiss bank

(the client wants to retain the possibility of disposition of income directly or indirectly);

- The amount of assets is about 2 million EUR;

- Currently the asset is registered personally on individual.

Tasks of client

- Ensuring safety of assets from potential claims by third parties;

- Ensuring (to the extent possible) confidentiality of structure;

- Optimality of variant in terms of tax burden and tax consequences

(income from securities should either not be subject to the burden of taxation or be taxed at minimum rate).

Proposal

Optimal way to solve the posed issue to You is transfer of assets to a foreign Trust or Foundation.

Hereinafter, detailed information on each structure is provided to your attention and the best jurisdictions

to create a structure are suggested.

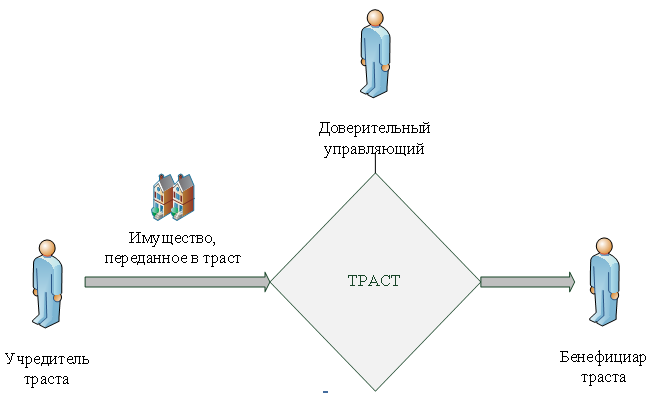

What is Trust?

Trust is the legal relationship arising between the three parties, in which the founder of the Trust transfers certain property to

another person - the manager of the Trust in order to manager, being considered as the owner of property,

administer it solely in the interests of a third party - the beneficiary.

How is asset protection ensured?

The beneficiary is the gain acquirer, but not the owner of property transferred to the Trust. For this reason, it is not possible to levy execution upon property of the beneficiary.

The manager, in its turn, although is considered to be the owner of the Trust’s property, is not liable on the personal commitments by this property. Therefore, it is also impossible to claim such property.

The founder of the Trust can not also be deprived of the property as it is transferred to the Trust on a pro bono basis, and according to such transfer the Founder ceases any rights on property.

It is only possible to levy execution on the property of the Trust when fictitious nature of the Trust or criminal intentions of its members are proven, which seems to be problematic and almost impossible in some jurisdictions.

What property can be transferred to the Trust?

Any property or property rights, such as cash, securities, movable property or real estate, intellectual property, insurance policies, etc. can be transferred to the Trust. Property, the transfer of which is expressly prohibited by the legislation of the country of establishment of the Trust, is not permitted.

Confidentiality

Information about the founder and the beneficiary of the Trust is indicated only in the Trust Agreement, which is not available to third parties and, in most jurisdictions, is not subject to registration in public registries. Persons having access to these data have the obligation to preserve them confidential, the disclosure of which provides for property liability.

The extent of publicity of information about trust managers depends on legal requirements of a specific country of Trust establishment.

Term of Trust

Validity of Trust agreement is established by the parties to the agreement themselves. In some jurisdictions, the time limits can be provided for.

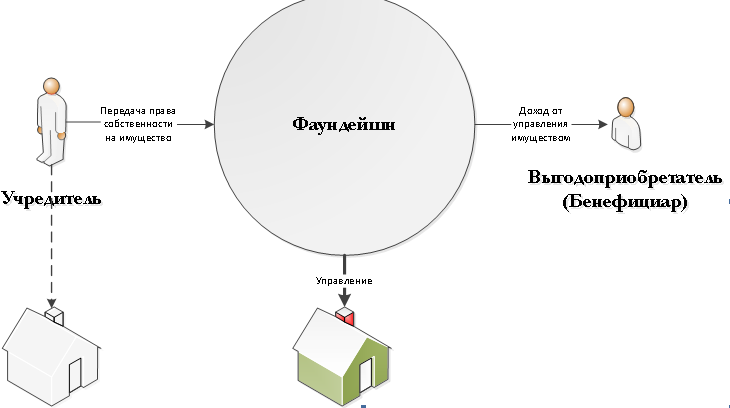

What is Foundation?

The Foundation is the legal entity, having no owners, to which its creator (founder) transfers his property in order to the Foundation owns and manages this property for the benefit of specified parties (beneficiaries) by the founder or for the achievement of indicated objectives by the founder.

What are the purposes of formation of the Foundation?

- For private family purposes, when, for example, the founder creates the Foundation to manage family assets for the benefit of family members and future generations. As a result, the founder can be assured that family property will be saved and spent in full accordance with his wishes during the centuries.

- For charity, when the Foundation owns and manages the property for the realization of charitable projects.

- In some countries, the law allows you to create the Foundation, which combines both private family purposes and charity.

Foundation Management

Supervisory board is created for management of capital and Foundation activities , and decides on what purposes the means of the Foundation are to be spent. In large Foundations, in addition to the supervisory board the so-called grant committees are created, in which experts are invited. In this case, decisions on the allocation of funding for a particular project are taken with the participation of experts.

Due to flexibility of legislation of a number of countries the founder is entitled to independently determine not only the composition of executive and supervisory bodies, but also the order of their interaction and work.

Board of Foundation

The Board is the chief managing and representative body, which consists of Directors, whose number is determined by the founder. Legislation of some jurisdictions has specific requirements for the number and the residency of directors.

Control over Foundation activities

Protector or auditing supervisory authority

Protector appointed by the founder monitors the activities of the board, checking for its compliance with objectives set. The Board regularly reports to the protector on its activities. In some jurisdictions, the appointment of the protector is a must, and in some - voluntary. As a rule, the founders appoint their authorized representatives to act as the protector.

Independent auditor is assigned to audit financial activity, which provides one-time and regular audits of financial activity of the Foundation. Existence of permanent auditing authority is mandatory only for charitable Foundation. However, on the request of Founder, such authority can be created for private Foundation.

What Foundation is needed for?

Means of asset protection

When transferring property to the Foundation the founder ceases right of ownership in relation to it, depriving creditors of the Founder the possibility to levy execution upon transferred property.

Inheritance planning

When transmitting property to the Foundation the founder can be confident that it will be allocated among the successors. Foundation in this case will act as a sort of executor and strictly abide the conditions specified by the founder.

Creating the Foundation, the founder indicates the list of transferred property, the names of the beneficiaries (successors), the powers of the executive and supervisory boards of the Foundation, the order of income distribution in favor of the beneficiary, the period of existence of the Foundation and other conditions.

Confidentiality

In most jurisdictions, the part of the constituent documents that contains important confidential information about the founder, the beneficiaries and the Foundation property is not available to third parties.

Taxation

If the Foundation does not conduct business activities or conducts it outside the country where it was created, income tax shall be not be levied. However, in some jurisdictions it is possible to levy annual tax on the capital, as well as the "stamp duty" during the registration.

Property

As a rule, the property transferred to the Foundation shall be exempt from taxation if it is not real estate located in the country of the Foundation registration.

Income of beneficiaries

The income of the beneficiaries are not also subject to taxation if it is earned outside the country of the Foundation registration. For these purposes, residents of the country of the Foundation registration are excluded from the number of potential beneficiaries.

Property of Foundation

In most jurisdictions, any property can be transferred to the Foundation, namely cash, shares and other securities, movable property and real estate, intellectual property, insurance policies and other assets.

Duration of Foundation

Duration of the Foundation is set by the founder. In general, the Foundation has the ability to exist independently of its creator for indefinitely long time by investing its funds and thereby increasing its capital. The oldest Foundation in the world's was established in the UK back in the first century AD, and it still exists and operates.

Taking into account the input data of the client, the best structure is the creation of Foundation in Liechtenstein, the Netherlands or Austria.

Detailed information on each jurisdiction and calculation of the cost of creating structure are provided below.

1.Liechtenstein

Legal regulation

The Law on the persons and organizations (Personen und Gesellschaftsrecht, PGR) of 1926 with further amendments.

Confidentiality

Information on beneficiaries is confidential and can be disclosed only by court decision.

Protection from creditors

Creditors will not be able to levy execution upon transferred property as it becomes property of the Foundation. Creditors have the right to challenge the transfer of property only in the case of fact finding that the transfer was the act of fraud against creditors.

Control

Founding member has the possibility to be manager, protector or beneficiary, keeping thereby the ability to control activities of the Foundation.

Lack of taxation

If the Foundation obtained income outside of Liechtenstein, it is exempt from all taxes, including income tax and capital gains tax. Payments to beneficiaries are also exempt from taxation.

Term of existence

Foundation can exist without any time limit or be established for a specified period or for the term up to recall of the expression of will by the founder at the discretion of the founder.

Property

Any property may be transferred to the Foundation, namely: cash, shares and other securities, intellectual property, insurance policies and other assets.

Cost of registration and annual maintenance :

| Service | Cost |

|---|---|

| Registration, annual tax | EUR 18 490,00 |

| Annual tax | |

| 1st year of maintenance | |

| 2nd year (each subsequent year) of maintenance | EUR 19 820,00 |

| Annual tax | |

| Annual administrative expenses |

2. The Netherlands (STAK)

Legal regulation

The main provisions are contained in the Dutch Civil Code, Book 2: 285-304.

Confidentiality

Information on the holder of depositary receipts is not to be published. Foundation is registered in the Commercial Register as the sole owner of the shares.

Protection from creditors

Creditors of the former owner of the shares will not be able to levy execution on the shares transferred to the Foundation, because the shares belong to the Foundation after the transfer. However, within three years, the creditors are entitled to challenge the transfer of property in the case of fact finding that the transfer was the act of fraud against creditors.

Control

The founding member of Foundation has the right to be its manager at the same time, keeping thereby the ability to control its activities.

Lack of taxation

Possession and management of the assets of other companies are not regarded as exercise of entrepreneurial activity. Thus, the Foundation will not be subject to corporate income tax.

Beneficiaries are exempt from income tax if they are outside of territory of the Netherlands, do not carry out any entrepreneurial activities in the Netherlands, are not established and do not have a permanent establishment (for legal persons).

Term of existence

The founder is entitled to independently determine the term of existence of Foundation, that can be established without time limitation.

Cost of registration and annual maintenance:

Service |

Cost |

| Procedure of auditing client, drafting the charter, exercising registration activities, providing services of director, providing legal address, payment of registration fees and notary services in the Netherlands. |

EUR 19 270,00 |

| Annual maintenance depends on the number transactions throughout the year. | _ |

In case of additional questions, please contact us, we will be glad to provide assistance.

Sincerely,

Olesya Bazhutova

Partner of the company

Law & Trust International