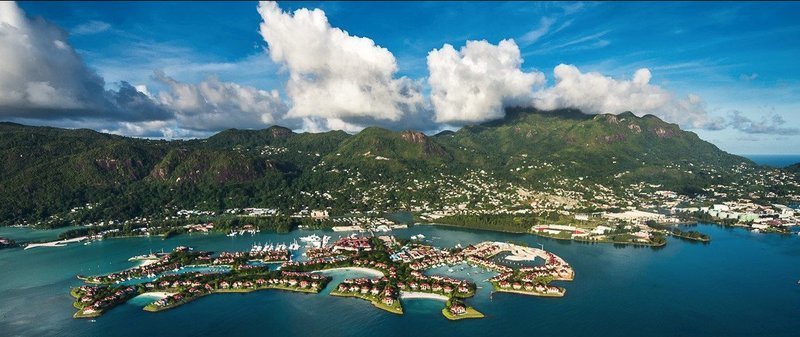

BEPS Legislation Seychelles

News:

Date added: 18.01.2019 Over 100 countries and jurisdictions are collaborating to implement the BEPS (Base Erosion and Profit Shift) measures and tackle BEPS.

Over 100 countries and jurisdictions are collaborating to implement the BEPS (Base Erosion and Profit Shift) measures and tackle BEPS.We would like to share with you the newly enacted amendments to the Seychelles legislation, namely to the Business Tax (Amendment) Act, 2018, The International Business Companies (Amendment) Act, 2018, The Companies (Special Licences) (Amendment) Act, 2018, The Insurance (Amendment) Act, 2018, The International Trade Zone (Amendment) Act, 2018 which are related to Seychelles commitment to the Base Erosion and Profit Shift standard of the OECD, which will take effect as of 1st January, 2019.

The brief description of the changes:

1. The Business Tax (Amendment) Act, 2018 moves Seychelles to a Territorial Tax System as of 1st January 2019.

2. The International Business Companies (Amendment) Act, 2018 allows IBCs to carry on business in Seychelles. In line with amendments in the Business Tax Act, the tax exemption clause under the IBC Act has been removed. Only IBCs deriving “Assessable Income” in Seychelles will be required to submit Annual Returns and Audited Accounts (in line with the Companies Ordinance 1972) to the FSA.

3. The Companies (Special Licences) (Amendment) Act, 2018 removes the 1.5% business tax concession and withholding tax exemptions. CSLs incorporated on or before 16th October 2017 may still be able to enjoy these tax concessions and exemption until 30th June 2021 (other limitations apply).

4. The Insurance (Amendment) Act, 2018 removes tax exemption provision applicable to non-domestic insurers. Non-domestic insurers licensed on or before 16th October 2017 may still be able to enjoy these tax concessions and exemption until 30th June 2021 (other limitations apply).

5. The International Trade Zone (Amendment) Act, 2018 allows the Minister to amend the Schedule or any regulation to the disadvantage of a person holding an export services licence only (i.e. this allows for the amendment to the Regulations (attached) to be issued) and to amend the Schedule or any regulation to the disadvantage of any holder of a licence vis-a-vis the Employment Act exemption and the Seychelles Pension Fund Act exemption.

6. The International Trade Zone (Amendment) Regulations, 2018 amended to remove the potentially harmful activities licensable under the Export Services licence. Under the revised export services regime, the holder of an Export Services License will not be allowed to provide any services other than repair and reconditioning of goods, warehousing and rental of storage space or logistic services provided that these activities relate to goods physically handled in the zone, in Seychelles. Export Services operators licensed on or before 16th October 2017 may still

7. The Mutual Fund and Hedge Fund (Amendment) Act, 2018 requires Fund Administrators to meet the minimum substance requirements in order to benefit from the concessionary tax rate.

8. The Mutual Fund and Hedge Fund (Substantial Activity Requirements) Regulations, 2018 provides that the substantial activity requirements shall be met if the fund administrator undertakes its core income generating activities in Seychelles with reasonably adequate number of suitably qualified persons and incurs an adequate amount of operating expenditures for such activities.

9. The Securities (Amendment) Act, 2018 requires securities exchanges, clearing agencies, securities facilities, securities dealers and investment advisors to meet the minimum substance requirements in order to benefit from the concessionary tax rate.

10. The Securities (Substantial Activity Requirements) Regulations, 2018 provides that the substantial activity requirements shall be met if the securities exchange, clearing agency, securities facility, securities dealer or investment advisor undertakes its core income generating activities in Seychelles with reasonably adequate number of suitably qualified persons and incurs an adequate amount of operating expenditures for such activities.