It is generally accepted that the United States is a jurisdiction with alternative taxation, but after 2018 the attitude has changed, as companies have been obliged to receive tax numbers and submit annual reports. At first glance, these changes may have a negative impact, but in fact, they open up great opportunities for companies. One such opportunity is to obtain a Certificate of Tax Residency.

This article will answer the main questions, namely: what is tax residency? How will this Certificate be useful for your business? If you still have questions, our specialists will always be happy to provide you with advice. Please contact us in any way convenient for you.

Let's start with the very first question - what is tax residency and how is it determined.

Tax residency, both for a company and an individual, is a “binding” to a particular state. This binding, whether it is citizenship or the country of incorporation, in accordance with the law, imposes certain rights and obligations on an individual or company.

In the case of the tax residence of companies, the obligations that are entrusted to the country of incorporation can be defined as follows:

- Register with the tax authorities;

- Submit timely reports to the tax authorities;

- Pay taxes on time.

If we are talking about rights, then it is worth highlighting the right to use tax benefits that are provided by the treaties between the countries on avoidance of double taxation and prevention of tax evasion in respect of taxes on income and capital.

The possibility of exercising such a right in the USA is carried out based on a tax residency certificate issued by the US tax authority (IRS), the so-called form 6166. A certificate of 6166 form is an appropriate confirmation of tax residency.

Thus, we came to the second question.

How will this Certificate be useful specifically for your business?

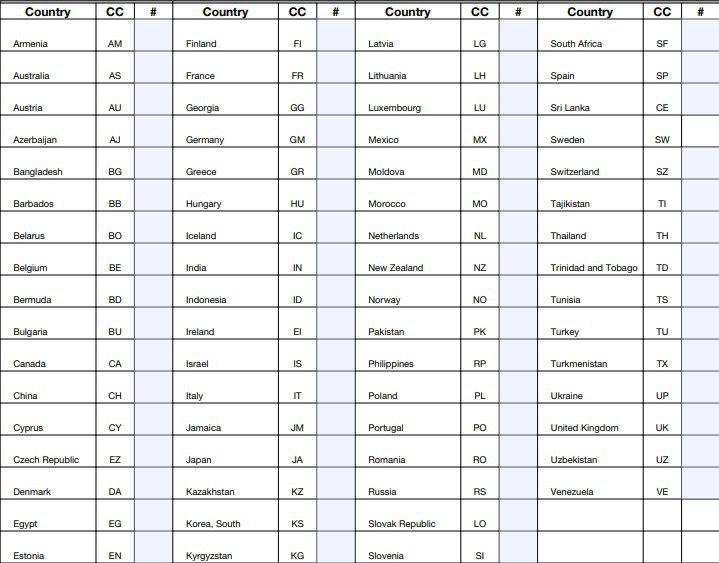

In general, as described earlier, this Certificate confirms your right to use tax benefits that were established between the United States and other countries, such as Ukraine, Russia, Kazakhstan, Uzbekistan, and others. (You can find the full list of countries in the table below.)

The benefit of this certificate is that you, as the owner of a company in the USA, can receive this certificate and provide it to the counterparty. After receiving, the counterparty will have to remove all taxes that were included in the invoice. In normal business practice, this is a value-added tax (VAT).

Thus, the amount that will be paid by your company will be "clean", without tax.

Absolutely all companies registered in the United States can obtain this certificate if they are identified as taxpayers in the United States. A company is considered as such if an EIN has been received. In the year when this Certificate will be requested, the company should not have any tax arrears, namely:

- A tax report must be submitted using one of the forms for internal companies (for example, 1120);

- If in the year in which the application for the Certificate is submitted, the company still does not have an obligation to submit a tax report, then the company must file a previously submitted tax report.

- If the company does not need to submit a tax report this year, then another document must be submitted that confirms the possibility of obtaining a Certificate.

The deadlines for submitting and receiving a Certificate of Tax Residency are also important.

The general term for receiving this document is from 30 to 60 days from the date of filing, you also need to take into account the month of submission, since the Certificate is issued for 1 year, and you can apply for it only after December 1 of the year preceding the requested one.

After the Certificate is generated, the US Tax Administration will send the original of this document by mail to the specified address.

Law&Trust specialists can provide legal support for the procedure for obtaining a Tax Residency Certificate, thereby minimizing labor and time costs for studying US law, the procedures for obtaining a Certificate and possible inaccuracies in submitting documents. For detailed information, please contact us according to the information indicated on the website.

Our clients