Cost of registration

from 3250 USD

The cost of the second year

from 1500 USD

Table of contents

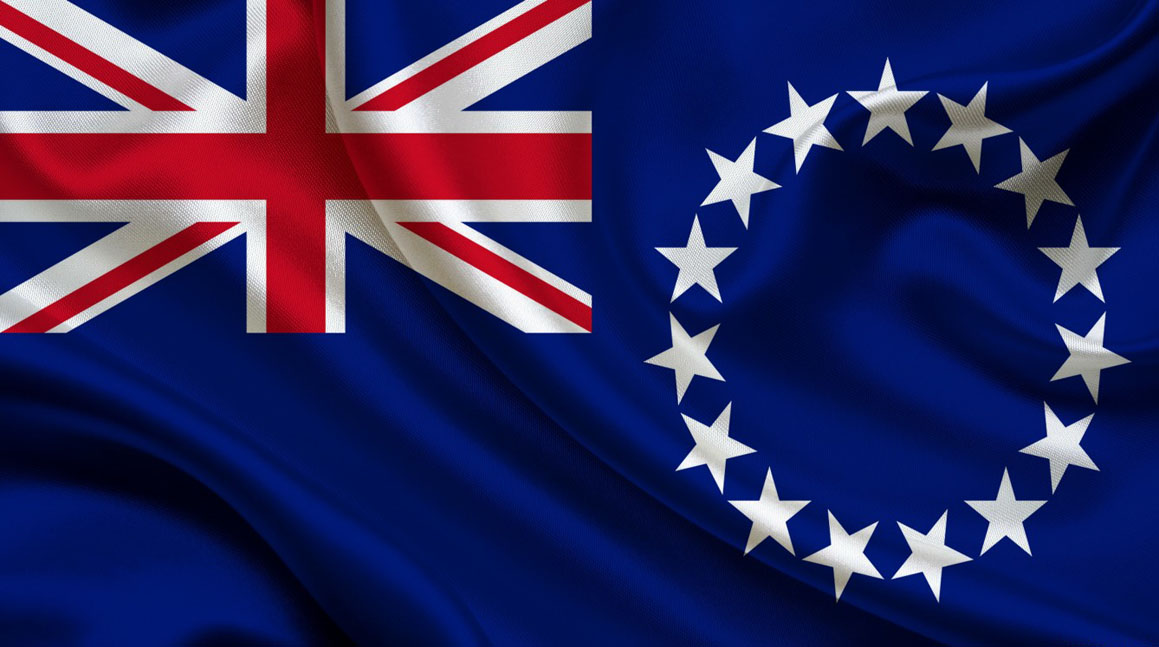

How to register company on the Cook Islands

The Cook Islands is an archipelago located in Oceania. More specifically, the islands are situated between New Zealand and Hawaii, in the southern part of the vast Pacific Ocean.

The northern part of the archipelago is represented by islands of volcanic origin, the southern part - by coral atolls. The archipelago is famous for its exuberant and diverse culture. Each island has its own traditional crafts and customs. The islands are especially known for traditional dance festivals.

The Cook Islands does not suffer from numerous tourist visits. They attract those who are ready to see what Polynesian lands were before the Europeans came there.

The area of the islands is 240 km2.

Approximately 21 thousand people inhabit the territory of the state.

Avarua is the capital of the Cook Islands. The official language is English, and the local Maori language is also widely used.

The New Zealand dollar is the local monetary unit.

According to its state structure, the Cook Islands is a parliamentary democracy (self-governing one).

English law underlies the local legal system. The country signed the Hague Convention.

The basis of the economy of the islands is tourism, agriculture, and fishing. The natural resources of the state are limited. Therefore, it regularly receives financial assistance from New Zealand.

Jurisdiction is also popular among those tending to register offshore company on the Cook Islands.

The legislative framework on the Cook Islands

- Law on International Companies (1981-1982);

- Law on Limited Liability Companies (2008).

Forms of doing business on the Cook Islands

Company formation on the Cook Islands makes sense and can bring huge benefit to its owner.

The most convenient variant for doing business in the Cook Islands is the International Company.

Peculiarities of offshore company on the Cook Islands

- The company can conduct any activities permitted by law;

- The company shall have registered office and registration agent in the territory of the islands;

- The name of the company on the Cook Islands should include the word Limited or the abbreviation Ltd;

- The amount of the authorized capital shall be equal to $ 5000. It is not necessary to pay it;

- Issue of bearer shares is not allowed;

- It is allowed to issue shares without declared par value;

- The minimum number of directors and shareholders (natural persons or legal entities) is 1 person;

- Nominee service is allowed (including directors and shareholders);

- Information on offshore banking transactions on the Cook Islands, as well as on the owners of the company is not available to third parties. Only the decision of the local court can cause its disclosure;

- Meetings of shareholders and directors can be held anywhere in the world;

- Owners of the company shall personally decide upon the place of storage of documents;

- There is no currency control;

- The terms of registration for offshore company on the Cook Islands is approximately two weeks after filing of all necessary documentation.

Bookkeeping on the Cook Islands

The company is not obliged to maintain accounting records and submit annual reports.

Taxes on the Cook Islands

Offshore company on the Cook Islands is completely exempt from the tax burden.

In order to start cost-efficient international business, it is possible to register or buy offshore company on the Cook Islands today. Offshore registration on the Cook Islands is not difficult task for us. Registration of companies, trusts, partnerships throughout the world is important direction of our company's work.

Our professional lawyers will help You to register company on the Cook islands.