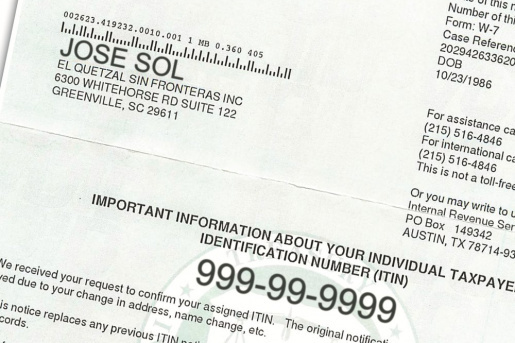

An Individual Tax Identification Number or ITIN is a tax ID number issued by the Internal Revenue Service. It is a nine-digit number that always starts with the number 9, and the fourth and fifth digits of which form a number in the range from 70 to 88.

What is the individual tax identification number used for?

If you are not a resident of the United States and do not have the right to receive the SSN, which is required when applying for opening a bank account, then you can get an Individual Tax Identification Number or ITIN. Thus, ITIN can be used as an alternative to SSN for non-residents.

ITIN can also be used both for conducting business activities in the USA and for submitting income reports to the IRS.

In turn, you need to pay attention to the fact that ITIN cannot be the basis for:

- Receiving SSN;

- Issuance of a work permit in the United States;

- Verification of identity.

Thus, ITIN is an individual tax number that can only be used in cases such as:

- opening a bank account;

- filing reports with the IRS for certain individuals;

- doing business in the United States.

Ways to get a tax identification number or ITIN

- Original identity documents (such as a passport), a completed application for ITIN, and a tax return can be sent directly to the IRS for review.

- You can contact an agent who has received permission to process and submit data to the IRS on behalf of the client. Such an agent is Law & Trust. You can find a detailed list of our services on our website.

When should you apply for ITIN?

This application must be filed at the time of registration of the company for the optimal quick receipt since the standard deadline for the receipt can be up to 8 weeks.

What is the validity period of ITIN?

The ITIN must be updated every 3 years if no federal tax return has been filed during these 3 years. Also, since June 2019, an official IRS announcement was published that the ITIN, for which federal tax returns were not filed in 2016, 2017, 2018, will expire on December 31, 2019. ITINs with middle numbers of 83, 84, 85, 86, or 87 will also need to be renewed. It has been pointed out that the U.S. Internal Revenue Service will send owners of such ITINs a CP48 notice of the recovery of their individual tax number. If you plan to apply for opening a bank account, it is better to check the status of your ITIN in advance.

ITIN recovery procedure

The recovery procedure for ITIN is no different from receiving it in general terms. Thus, the methods and timing for recovering ITIN are identical to those obtained. After the procedure, the IRS will send you a letter with the date of restoration. It should be noted that during restoration the number is not changed, only the number changes.

Penalty for late recovery of ITIN

Fines are not provided for in US law. However, we want to draw your attention to the fact that an ITIN that has expired will not be accepted by any government agency or system. If an ITIN was used to open a bank account, the bank may request confirmation of recovery.

The difference between EIN and ITIN

As noted earlier in the article about EIN, an Employer Identification Number or EIN is a unique number that is assigned to each business by the Internal Revenue Service in the United States and is used to identify the business. This number is required for all businesses registered in the United States. In turn, ITIN, as an individual taxpayer identification number, is situational and must be received when opening a bank account.

The difference between SSN and ITIN

An SSN or social security number is a number that is issued to American citizens or foreigners legally residing in the country. This number is issued by the Social Security Administration, it is issued only once and does not require restoration, as it is unlimited. In turn, ITIN is an individual number that is issued to individuals who do not have a reason to receive an SSN but must file federal tax returns.

Persons who need to file federal tax reporting can be divided into the following categories:

- To obtain tax advantages;

- If the income received is related to trading or business activities in the United States.

Law & Trust specialists can provide legal support for obtaining and recovering ITIN, thereby minimizing the labor and time costs of studying US law, the procedures for recovering ITIN and possible inaccuracies in submitting documents. For detailed information, refer to the data indicated on our website.