Business in Dubai

Business in Dubai: Establishment of offshore company

The specialists of Law & Trust are engaged in registration of business in Dubai. Applications are accepted from legal entities and natural persons with citizenship of any country. All companies in the territory of this Emirate are divided into two types: onshore and offshore ones. The second type is intended for establishing business in Dubai by foreigners with the possibility of 100% ownership of the company's shares.

Onshore companies are usually owned by local entrepreneurs or have the division of shares in the following ratio: 51 percent of securities belong to resident of the United Arab Emirates, and no more than 49 percent can be owned by foreigner who is citizen of any country.

The experts of Law & Trust ensure the establishment of business in Dubai within the shortest period of time, which is impossible with independent appeal to the licensor of this state.

The following can be considered as advantages of using our services:

- Detailed knowledge of the country's regulations and constant examination of amendments, which makes it possible to quickly interpret legal documentation;

- Long-term experience of cooperation with licensors of each of the Emirates and, in particular, Dubai;

- The opportunity to provide the client with ready-made business in Dubai, involving license on full-fledged legal basis.

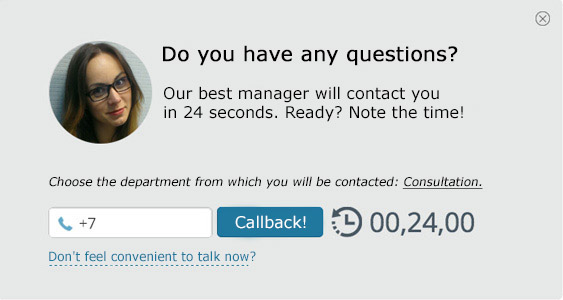

You can leave application for our specialists by phone, mail or at the company's office. Before personal visit, you should make appointment for consultation to avoid queues.

Establishment of business in Dubai: What should be focused on

- Selection of free economic zone. Dubai has several FEZs, each with its own licensor and requirements for the applicants. Most zones have specific sectoral focus. There are FEZs in the sphere of public health, high technologies, educational sphere and miscellaneous. The presence of number of business partners from the same business sector will help create new ideas and adapt.

- Types of licenses. The main licenses for establishing business in Dubai are trading and service ones. The first type of license entitles to carry out trade relations with counterparties, and the second allows to provide services in the selected scope of activity. In addition to the first two types of license, certain free economic zones issue manufacturing license. This means that entrepreneur can produce particular type of goods.

- Necessity for additional licensing. In some spheres, in addition to the core business certificate, additional license is required. The foregoing applies to medicine, technology, financial and other sectors. In order to clarify the full list of areas of operation for additional licensing, you can contact Law & Trust by phone.

- Amount of the authorized capital. When registering business in Dubai, there is no need to transfer large funds to the account of local banks. Standard amount of the authorized capital equals to 13,700 US dollars. In local currency, the amount equals to 50,000 dirhams, but not all FEZs require to convert funds. The purchase of additional licensing can be much more expensive, which should be taken into account by businessmen.

- Types of incorporation when registering business in Dubai. Almost all free economic zones offer registration of private business in the following forms: new company, branch of existing company, and subsidiary of large corporation. Depending on the type of incorporation, documentation package should be prepared.

Ready-made business in Dubai: Pros and cons of acquiring

The experts of Law & Trust International offer the clients to become owners of their own companies without long-term collection of documentation and extra expenses. Not only natural person, but also representative of the corporation can buy business in Dubai, however for the first group of applicants the process is more relevant. Legal entities are more often engaged in extension of the existing organization by establishing branches or subsidiaries.

Main advantages of buying ready-made company are the following:

- The term of registration of business in Dubai upon the request of the client takes from two to five weeks, depending on the Emirate. Buying ready-made company makes it possible to start acting as legal entity a few days after the application was submitted to the specialists of Law & Trust;

- Regardless of the founder's residence, he should find the official address for the registration of the company's head office. Local residents can use the addresses of their own apartments, and foreigners have the possibility to rent offices, living quarters, warehouses and other types of property in free economic zones, but rent requires significant financial contributions. When buying ready-made business, the client does not need to search for the object of rent in advance and overpay money;

- The established enterprise has official license to conduct activity in the United Arab Emirates (for local residents) or in other regions (for offshore companies). It is not necessary to wait for long-term consideration to obtain certificate and be afraid of refusing to register business in Dubai;

- New company has a "clean" history, and it is registered with all required state authorities. The buyer is provided with full package of constituent and accounting documents.

Our lawyers offer cooperation on mutually beneficial terms: you can buy ready-made business in Dubai and order subsequent audit or accounting support of the enterprise. Appointing authorized representative from among our company's lawyers will provide opportunity to be aware of the amendments to the legislative norms and the slightest changes in the requirements for non-resident firms.

Among the main reasons for popularity of business registration in Dubai, there are not only large number of population, tourists, but also high rate of economic development in the region. For all businessmen, the level of taxation within the territory of the establishment of the company is important.

In Dubai, both local entrepreneurs and foreigners are exempted from paying state duties, which allows to redirect all profits to business development. The only type of payment that shall be contributed annually is the fee for licensing the company. The amount of the fee is inconsiderable, but one should not delay with the transfer dates.

You can get free consultation regarding the procedure of establishing business in Dubai or buying ready-made company today: the applications are accepted online, by phone and through the mail of our website.