CREATION OF THE VENTURE FUND

Date added: :

17.07.2015

To avoid complex definitions of the concept of a "venture fund", we describe it like this: it is a company that specializes in financing innovation projects (start-ups), and there is no guarantee of its successful implementation.

The risk of investing in a non-profitable project is quite high. By the way, the foregoing led to the name of the fund - venture fund (from venture - "risky enterprise"). But in case of success, investors quickly refund and recover their expenses to the maximum extent.

Therefore, venture fund is an undertaking for self-confident entrepreneurs, for whom risk is an integral part of a successful and prosperous business.

We draw your attention to the fact that the venture fund is not the owner of capital, but only manages it. And the funds forming the fund are distributed and come in the form of rewards and remunerations from the owners of capital.

The specifics of the procedure are defined in the contract, which is concluded by the manager and founders of the fund.

Advantages of a venture (investment) fund:

- Stability and constancy. It's about the ability to relatively without serious consequences tolerate a fall in quotation of shares of partners. After all, damage from one project can be covered by profit from another. For this, of course, the fund should work with several start-ups at once. In this case, the so-called diversified portfolio becomes the saving instrument.

- Protection provided by the structure of the fund. There is no dependence between the management company and the depositary. Therefore, in case of insolvency of the management company, the fund will be transferred to another one.

- Good liquidity of the investment unit. So a participant who needs money for other purposes can quickly return own investments.

- Access to financing of innovations is received by small market players. This is facilitated by a significant reduction in operating costs.

- Exclusion of the subjective approach: formal commercial relations are much more practical than the person-oriented approach of the startuper to its "business angel investor".

In order to minimize risks and get an adequate assessment of planned investments, we advise you to contact the professionals in advance. Lawyers of Law&Trust International will help you with the creation of a venture fund without unnecessary costs and wasting time. You can find out more information on this issue during private conversation with our specialist in the office, by phone or in chat.

Types of Venture Funds

- Closed type (private). It is characterized by a fixed amount of funds and number of participants. The enterprise exists for a limited period of time, after which each founder takes his share of profits.

- Open type (public). There are no above-mentioned limitations for the fund, its period of operation is actually unlimited.

Also, investment funds are classified as follows:

- Self-liquidating funds. They are created for one or more related projects. Participants receive profit at the last stage of the fund's activities.

- "Evergreen" funds. They are based on the principle of reinvestment. When moving to the next project, the participants return their initial contributions.

- Decent club investments. The fund is not registered, as it is informal. This is an association of investors. Resources are managed by an existing fund company.

Venture fund as an instrument of tax optimization.

Today the venture fund is an effective and very popular means of minimizing the tax burden. After all, income tax must be paid only upon its closure. That is, the fund legitimately avoids paying taxes for quite a long time.

Legislative basis.

The procedure for the operation of venture funds is determined by the relevant laws of specific jurisdictions. In Russia, it is, for example, the Law on Joint Stock Companies and Article 103 of the Civil Code of the Russian Federation.

How to register a venture fund?

There are various organizational and legal forms for the registration of a venture fund:

- partnerships;

- unions;

- companies;

- associations.

In the world practice there is a tendency to register private limited partnerships, consisting of the principal and limited partners.

In certain EU countries, the main advantage is given to closed joint-stock companies (CJSC). The investor in this case pays the tax only on a share/part of the profit from the fund.

It is possible to register an international venture fund in any country in the world. As a rule, jurisdiction is selected with less regulation and lower taxation for this purpose.

Registration of an investment fund in the form of a joint-stock company provides for the availability of:

- The founder, who may be natural and/or legal person(s).

- Shareholders (usually up to 50 people), between which the capital will be distributed.

- Initial capital. Typically, this is the equivalent of $5- $10 million. Average investment volume of each participant will then amount to $750,000, and the risks that each investor incurs will be commensurate with the amount of investment in a particular project. The property of fund participants can also be used to pay the charter capital.

- Charter, which has the value of the constituent document.

- Investment memorandum. This is a supporting document, which specifies the objectives and directions of investment, as well as regulates the activities of the fund. There are the main provisions of the Memorandum:

- strategy of activity;

- jurisdiction;

- business model of the company;

- management structure;

- top management;

- criteria for selecting projects for investment.

- Seals of the company with its name and location.

- Opened bank account.

Internal organization of venture fund

Annually, the Board of Directors is elected with the participation of co-founders and shareholders of the fund. And the main investors and, in some cases, the top managers of the fund form an investment committee. At this level, all the most significant decisions are made in the work of the investment company. The remaining positions are distributed by decision of the Board of Directors.

As a rule, hired workers are involved in the management of funds. The functions of the manager are performed by the trust manager (estate trustee or executor).

The Board of Directors also appoints a general partner who himself manages the fund or controls the work of the manager. This employee is not one of the investors.

At the fund-raising stage, financial management specialists are attracted to operate in the fund.

Qualified consultants, auditors, and managers are involved in the process of preparing for direct investment.

The Advisory Council is another "non-public" body of the venture fund. Its presence is especially characteristic to Western companies. The council may include representatives of the financial community, politicians, lawyers.

The entire staff of the fund, as a rule, is up to 20 people.

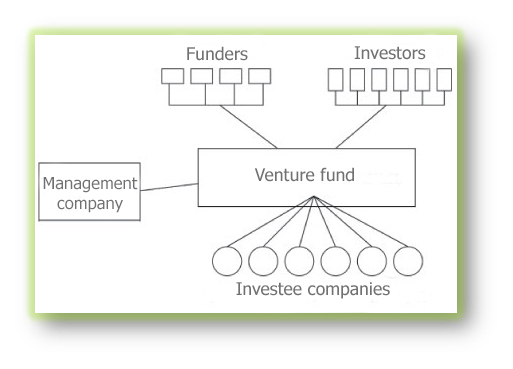

The main parties involved in the work of the investment company:

- investors;

- venture fund;

- managing company;

- company-object of financing.

Schematically it looks like this:

The term of operation of the fund is about 10 years. This period, as a rule, is enough to return the invested capital and make a profit.

Among the current costs of the investment company, payment of remuneration to the team of the fund should be allocated and taken into account. By foreign standards, the basic rate is about 1.5-2%, plus incentives in case of excess of the planned profitability (about 20% of excess profits).

The expected profit on leaving the business is usually 20-40% of the amount of capital investment.