Optimization of taxation in payment of royalties from Russia

Date added: :

14.06.2014

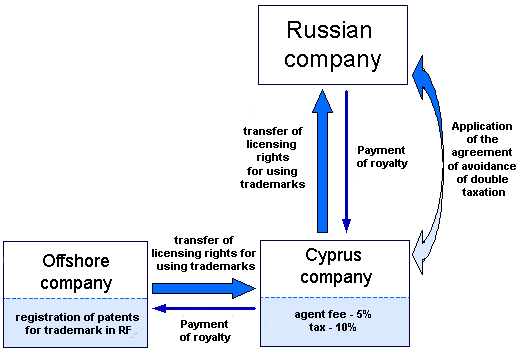

The income in such transfer of rights to the objects of intellectual property will consist in obtaining royalties, which are paid as a remuneration for the use of another's intangible asset. A classic means of formalizing legal relationships between the owner of intellectual property and the person wishing to use the asset is to create a chain of three links.

The first link is the right holder (offshore company), the second is the licensee (a company registered in Cyprus or in other jurisdictions that has an agreement with Russia on avoiding double taxation), the third is the Russian sub-licensee.

Russian company, as a sub-licensee, pays royalties to its licensee - a Cypriot company, which, in turn, pays royalties to the right holder of the intellectual property object - an offshore company. In this chain, the company in Cypriot jurisdiction is used as an intermediary, because the funds from Russian counterparty in its favor, in accordance with the said Agreement, are exempt from taxation. This makes it possible to use the object of intellectual property on the territory of Russia, while accumulating all the royalties in the offshore zone. This scheme of work is very popular, but it is worth paying attention to a number of significant nuances.

In addition to the agreement between Russia and Cyprus, analogous documents on the avoidance of double taxation have been signed with a number of other states. Agreements exempt Russian companies from royalty taxation, but it is necessary to take into account the peculiarities of each country's tax systems.

Withholding taxation of royalties

In accordance with Article 309 of the Tax Code of the Russian Federation, income from the use of intellectual property in Russia is taxed at a rate of 20%. The subject of taxation is the source of payments - a Russian company.

But, since in our example the Russian company makes payments to the Cyprus company (located in the country with which Russia signed the Agreement), such payments, in accordance with paragraph 1 of Article 12 of the Agreement and subparagraph 4 of paragraph 2 of Article 310 of the Tax Code of the Russian Federation, will not be taxed and the Russian company will not have a duty to withhold tax from the source of payment of royalties.

Exemption from withholding and payment of tax from the Russian company is possible only if the Cyprus company, as the payee, provides the Russian counterparty with a document confirming its permanent location in Cyprus.

Such a document (tax residence certificate) must be certified by the authorized body of the Republic of Cyprus and confirm the fact that the company is a resident of Cyprus in legal relations established by the bilateral Agreement of 1998. Also the document should contain information on the calendar period during which the company's status is confirmed as resident of Cyprus. This period should correspond to the period of payment of royalties. The document should be translated into Russian and properly apostilled (contain a stamp that confirms the validity of the document abroad). It is worth noting that as a confirmation, you can not use the document on the legal address of the company, in particular - the certificate of incorporation.

In accordance with subparagraph 37 of paragraph 1 of Article 264 of the Tax Code of the Russian Federation, such payments as royalties refer to "other costs related to production and sales". For tax purposes, in particular, to determine its base, any costs should be economically justified and documentarily confirmed.

To assign the costs of royalty payments to the tax base of expenses, the intellectual property object should be directly used by the company in accordance with article 1484 of the Civil Code of the Russian Federation (for more information, see Letter No. 03-03-10 / 60 of the Ministry of Finance of the Russian Federation of June 4, 2012). Such use lies in any legal means, including through the placement of a trademark on goods, in advertising, on signs, in shipping documentation, on the Internet, and so on.

The Cypriot company's income from royalties will be subject to taxation at a rate of 12.5%, while according to special rules that were put into effect in 2012, 80% of the profit received from such payments will be exempt from taxation. In fact, this means that revenues from obtaining royalties will be taxed at an effective rate of 2.5%.

VAT on payment of royalties in favor of foreign counterparties

If Russian company acquires the rights to use the object of intellectual property from a non-resident company, the territory of the Russian Federation (subparagraph 4 of paragraph 1 of Article 148 of the Tax Code of the Russian Federation) will be considered the place of realization/sale of such services, and the foreign company is the subject of VAT payment. In the event that the foreign counterparty does not have a registration with the tax authorities of the Russian Federation, Russian company will be the tax agent for the payment of VAT.

In this case, the Russian company has an obligation to charge, withhold and pay VAT to the budget. In accordance with subparagraph 2 of paragraph 4 of Article 174 of the Tax Code, VAT is paid simultaneously with the payment of royalties to the counterparty. Subsequently, the amount of VAT paid, in the order of paragraph 3 of Article 171 of the Tax Code, may be deducted. The basis for such deductions may be invoices and documents that confirm the size of the amounts paid as the tax.

It should be noted that in accordance with subparagraph 26 of paragraph 2 of Article 149 of the Tax Code, the use of exclusive rights to know-how, databases, topology of integrated circuits, utility models, inventions, industrial designs, as well as any exercise of rights to such objects are not subject to value added tax in Russia.

Registration of licensing agreements

Current legislation of the Russian Federation sets forth a number of requirements for licensing agreements. According to the norms of Article 1490 of the Civil Code of the Russian Federation, such an agreement must be concluded in writing and pass the process of state registration with the federal executive authority on intellectual property (Rospatent). Deviation from such requirements leads to the invalidity of the licensing agreement.

It is worth noting that the Ministry of Finance of the Russian Federation, in its letter No. 03-04-08 / 12 of January 18, 2006, expressed the opinion that companies are not entitled to reduce taxable profits by the amount of royalties paid before the state registration of the relevant agreement in the Rospatent.

The Administrative Regulation of 2008 establishes the period during which the Rospatent is obliged to conduct state registration of a licensing agreement. This period is 2 months from the date of receipt of the registration documents, but in practice, for one reason or another, the procedure may take considerably longer.

Legal risks when paying royalties

It is worth noting the main risks that the Russian company may face, working according to the described scheme:

- deviation of the sums of royalties from market indicators;

- possibility of recognizing expenses as unreasonable;

- the parties to the agreement depend on each other;

- the rule of "actual recipient of income";

- other risks, including regulatory ones.

Given these risks, when structuring royalties, it is advisable to focus on the market indicators of royalties, carefully document all transactions, and also have solid evidence of the actual use of the intellectual property object in economic activities. At the same time, it is necessary to take into account not only the current provisions of the Tax Code of the Russian Federation and international agreements, but also to orient oneself in arbitration practice in considering relevant disputes, and take into account the opinion of the Federal Tax Service and the Ministry of Finance.

Of course, each situation requires its own approach based on the circumstances. The answer to any question should be given only after a careful study of a number of important factors and an assessment of possible risks. But, subject to competent preparation and knowledge, with the involvement of qualified specialists in the field of accompanying relevant projects, royalties can be an excellent instrument for optimizing the tax costs of enterprises.

Law&Trust International provides a wide range of tax planning and optimization services. When ordering planning and optimization of taxation from us, you receive professional advice and considerable savings of your funds.