FTS Monitors Online Transactions

Date added: :

16.08.2019

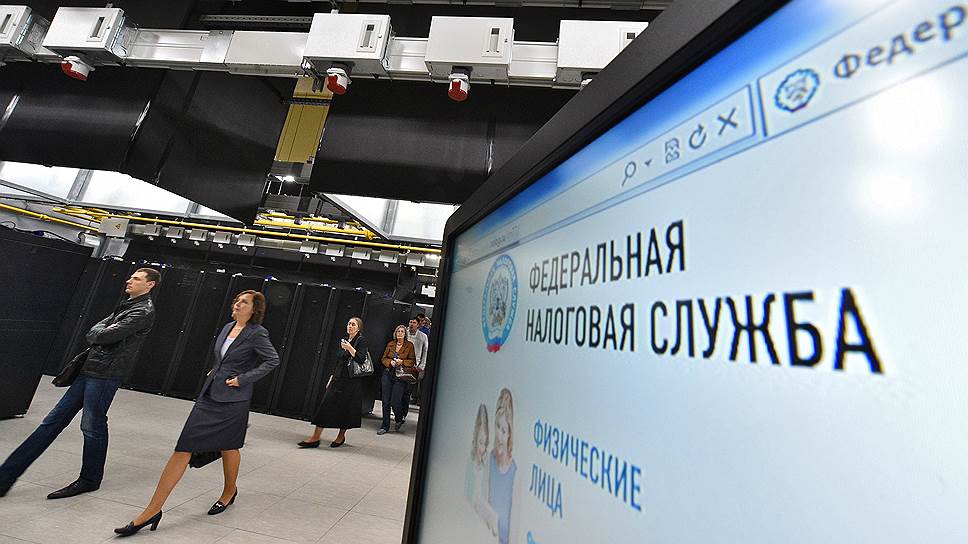

The Federal Tax Service announced the introduction of new technologies that allow tracking transactions of residents of the Russian Federation online. The Head of Tax, Mikhail Mishustin, spoke about updated technological solutions that control financial transactions and significantly save time. It takes only 1.5 minutes to generate a report, which will not only facilitate the work of the representatives of the Federal Tax Service but also significantly increase the efficiency of detecting fraudulent schemes.

The Federal Tax Service announced the introduction of new technologies that allow tracking transactions of residents of the Russian Federation online. The Head of Tax, Mikhail Mishustin, spoke about updated technological solutions that control financial transactions and significantly save time. It takes only 1.5 minutes to generate a report, which will not only facilitate the work of the representatives of the Federal Tax Service but also significantly increase the efficiency of detecting fraudulent schemes.

How does it work?

The new system developed by the Tax representatives is used primarily for small and medium-sized businesses. Unfortunately, large companies and oligarchs are unlikely to feel its effect on themselves. However, there are some advantages at a lower level.

First of all, the new system is aimed at reforming the schemes by which VAT is paid and refunded. According to Mishustin, the tax authorities have integrated new technologies that will clear the business of VAT fraud. With these innovations, retailers are now obliged to prepare constant electronic reports on accounts and install innovative cash registers equipped with a fiscal drive. These devices are connected via the Internet to the Information Processing Center, which allows maintaining constant communication.

Thanks to such changes, representatives of the Tax Office have the opportunity to check the invoices and payment of VAT to the budget at any time. The system is based on artificial intelligence, which automatically performs all checks. If suddenly a link is submitted without information, then the AI immediately notifies the specialists of the Federal Tax Service about this, submitting all the necessary information about the negligent payer.

What other measures have been taken?

The Federal Tax Service is doing everything possible to maximally cover all areas of the business, including taxis, freelance, and services, where people work only for themselves. Controlling these areas is especially difficult. Therefore, in 2019, tax officials suggested that people themselves disclose their income and legalize it at a reduced tax rate.

To prevent this, they developed a special offer that automatically calculates 4% of monthly income. While the application is working in test mode in several regions of Russia, it is already showing impressive results. Now the tax authorities are busy preparing schemes for each region. The Federal Tax Service expects that the full integration of the service will significantly increase tax deductions.